A tipping point for long-term care?

The horrific level of death in nursing homes and long-term care facilities may point to a new model; are communities ready?

The pandemic has hit long-term care institutions particularly hard, and the effects are likely to persist, including a shift to more home-based care and changing projections for the cost of care.

The horrific level of death among residents and staff in care facilities has called into question the model of institutional care. Meanwhile, costs are jumping, driven by accelerating pressures on care facilities.

In nursing homes, deficiencies in infection prevention and control are widespread. A study published in May by the U.S. Government Accountability Office found that 82% of nursing homes had an infection prevention and control deficiency citation in one or more years from 2013 through 2017.

Nursing home occupancy was down roughly 15% last year, according to a review of federal records by The Wall Street Journal published just before the holidays. That has left the industry in precarious financial shape. And many in the industry foresee a shift to more home-based care - but that’s going to depend on our ability to shift to a more home-centered system of care. That has implications for our housing stock and communities, which are not geared for an aging population.

“If there's anything good that comes out of [the pandemic], and there's not much, it will be an opportunity to at least try to reshape some of the ways that long term care is provided that are more desirable, less expensive and safer,” notes Max Richtman, CEO of the National Committee to Preserve Social Security and Medicare, an organization that works on a range of issues related to financial security and health.

Insurance Markets

Outside of Medicaid, insuring against long-term care risk remains a patchwork. The commercial business hasn't penetrated the potential market widely - it is hampered by the difficulties carriers have had properly pricing risk—and human behavioral resistance to sinking large sums of money into premiums for a risk that may or may not turn into a future need.

Many people will wind up covered under Medicaid, which funds care only in cases where a patient's assets have been almost completely spent. Meanwhile, a great deal of care is provided by family members. That can lead to other problems, including job interruption, reduced Social Security benefits and retirement saving, and general financial instability for the provider of care.

The average annual premium among top insurers selling commercial policies for a couple, both age 60, is $5,600 this year, according to the American Association for Long-Term Care Insurance (AALTCI). That policy would include a 3% annual inflation rider.

How much inflation protection do buyers need? Consider that the cost of care routinely jumps at rates far greater than general inflation, as you can see from the chart below, excerpted from the national Cost of Care survey by Genworth.

Jesse Slome, AALTCI’s executive director, notes that most people who need care will access it in a home setting—an AALTCI survey of insurers found that 70% of claims start with home-based care, and a majority end that way, too. Home-based care typically runs about half the cost of institutional care - but it has been escalating rapidly, too - note the figures above.

A shift to home- based care has other implications for needed reforms:

A better approach to long-term care insurance. Ideas for reform have surfaced in recent years, starting with a flurry of reports in 2016 that called for a hybrid public-private approach to financing long-term care costs.

Retrofits of homes to support older residents. Studies have shown the U.S. housing stock faces a major shortfall of age-friendly housing (e.g.. minimizing use of stairs, universal-design showers, doorways, cabinets, using home technology to monitor health).

Age-friendly communities. Even if people have appropriate housing, they need to get out and about in their communities to maintain vital social connections and avoid isolation. Here, again, the U.S. is falling short - research shows that far too few communities measure up. And the availability of age-friendly housing that does exist is not equitably distributed among the population - it tends to be most available in more upscale, less-diverse communities.reports, which were developed by a nonpartisan consortium of researchers, called for streamlining and simplifying private long-term care insurance to make it work better, but also covering the most extreme risk through a publicly financed insurance program.

Year-end tax tips for retirees

This year, a number of changes might impact tax planning for retirees. In this video, Christine Benz of Morningstar talks with tax expert Tim Steffen of Pimco about these nuts and bolts topics:

The hiatus on required minimum distributions, and how to get money back into accounts if you took distributions early;

What to do if you’re suddenly in a lower tax bracket

Building Roth conversions into your plan

Qualified charitable distributions

Estate planning at the annual gift exclusion

Christine and Tim also get in to a brief discussion of changes that might be on the horizon under the Biden administration.

Financial planner and journalist Roger Wohlner just published this very comprehensive guide to Roth conversions - how they work, and the pros and cons.

How will internet connectivity impact health care access?

Medicare has widely broadened the use of telehealth services during the pandemic. Virtual healthcare provided by video or phone link has been a lifeline for people who might have otherwise gone without receiving health services at all.

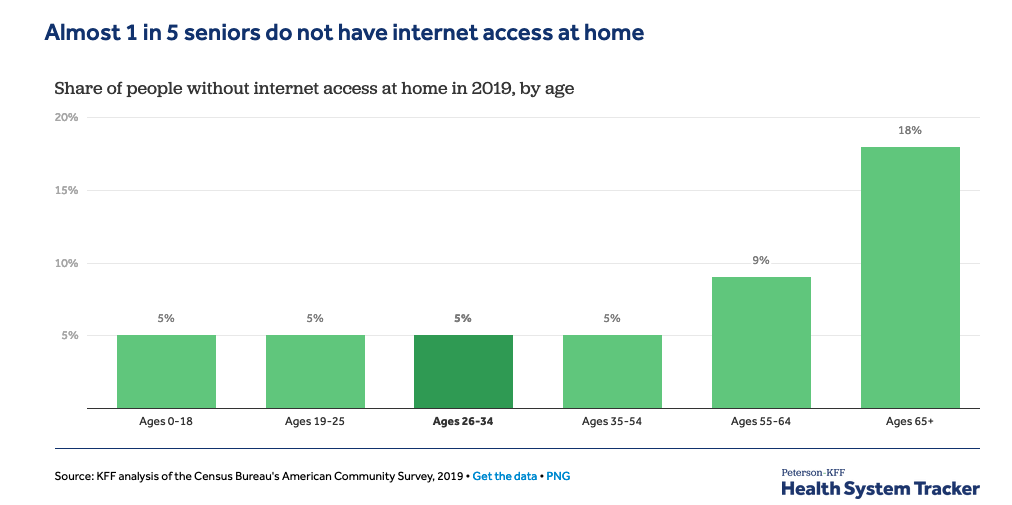

But health care policy experts worry that unequal internet access will create barriers to healthcare. The Petersen-KFF Health System Tracker recently published new data examining these barriers.

Among the striking findings:

Nearly one out of five seniors don’t have internet access at home.

25 million Americans lack access to internet at home

A higher proportion of Hispanic and Black Americans did not have internet access at home in 2019

Virtual volunteering, Part 2

Volunteers are the lifeblood of nonprofit organizations, but the pandemic has created major barriers to participation, especially for older people, who face a higher risk of serious illness or death if they contract the coronavirus. As a result, nonprofit organizations and volunteers are grappling with the challenge of finding new, safe ways to engage with older volunteers.

I wrote about some of the innovative approaches that are surfacing in this story for The New York Times last fall, and here’s one more. Kerry Hannon reports for Next Avenue on Eldera, a new, free global mentorship program. Eldera pairs adults 60 and over with kids — mostly between 8 and 13 — to nurture and boost inter generational relationships:

Eldera stands for "era of the elders," says its co-founder Dana Griffin, 38, a former data and advertising executive who grew up in the Transylvania region of Romania. She launched the service in March with Jules Olleon, 33, an engineer with expertise in artificial intelligence, security and user privacy.

Parents initiate the mentoring connection by applying to Eldera. Once younger and older people are matched, Eldera brings them together for virtual sessions over Zoom. Eldera provides the mentor and the mentee's parents with a video link for their conversations. Most mentors spend between 30 and 90 minutes per week talking with their mentees.

Other intergenerational platforms, Kerry notes, inculde Encore.org's Generation to Generation; the pandemic-inspired global volunteer groups Big and Mini and Sharing Smiles, an initiative of the nonprofit Empowering the Ages; the Boombox Collaboratory; CIRKEL and CareerVillage.org, which connects underrepresented youth with volunteering professionals who answer career questions.

COVID: vaccines and other updates

After 110K virus deaths, nursing homes face vaccine fears. After 110,000 deaths ravaged the nation’s nursing homes and pushed them to the front of the vaccine line, they now face a vexing problem: Skeptical residents and workers balking at getting the shots.

The vaccines are supposed to be free, but surprise bills could happen anyway. When Americans receive a coronavirus vaccine, federal rules say they shouldn’t have to pay anything out of pocket. But surprise vaccine bills may find their way to patients.

A year into the pandemic, what scientists know about how it spreads, infects, and sickens. A year into the pandemic, the authoritative online heath newsletter STAT offers this comprehensive portrait of SARS-CoV-2 based on what scientists learned as the virus raced around the world, crippling some economies, societies, and health systems in its wake.

The mysterious link between COVID-19 and sleep. The Atlantic’s James Hamblin reports that the coronavirus can cause insomnia and long-term changes in our nervous systems. But sleep could also be a key to ending the pandemic.

Why vaccinated people still will need to wear masks. The new vaccines will probably prevent you from getting sick with Covid. No one knows yet whether they will keep you from spreading the virus to others — but that information is coming.

Don’t let the pandemic stop your shots. Even as older adults await the coronavirus vaccine, many are skipping the standard ones. That’s not wise, health experts say.

The plague year: The mistakes and the struggles behind America’s coronavirus tragedy. If you think you’ve read all you can handle about the pandemic, think again. The New Yorker’s Lawrence Wright has published an article that is a real tour de force on the calamity that is COVID19. Wright is a well-known novelist, and his magazine story actually reads like a novella It occupies most of the January 4/11 issue of The New Yorker.

Book notes: Jobs you can do in your pajamas

Kerry Hannon’s excellent Great Pajama Jobs: Your Complete Guide to Working from Home is an audio book now, read by Kerry . . . Tom Vanderbilt’s Beginners: The Joy and Transformative Power of Lifelong Learning explores how learning skills can open new worlds for adults.

Recommended reading

Slate’s annual list of the most influential people over age 80 . . . A nursing home in a pandemic . . . The horror of working in a plague . . . The aging of dogs . . . Americans mark another surreal holiday in a grim year . . . My frugal father’s habits make sense now . . . What you need to know about the new Department of Labor fiduciary rule . . . A great cultural depression looms for unemployed performers . . . A need for re-authorization of the Elder Justice Act . . . The SEC approved new rules governing advertising by financial advisers, a step that liberalizes their use of broadcast and social media, and testimonials . . . The secret to longevity? 4-minute bursts of intense exercise may help . . . Workers tap retirement savings as a last resort.

A festival of winter light like no other

Nabana no Sato, a botanical garden in the Japanese prefecture of Mie, is home each year to one of the country’s best and biggest winter light festivals. During several months, magical light tunnels, animated light shows and millions of LED lights immerse Nabana no Sato into an endless sea of light.