Employer-sponsored health insurance costs keep soaring

The total out-of-pocket cost of employer-provided health insurance has soared over the past decade, according to the latest annual survey of costs by the Kaiser Family Foundation.

Ok, this is a newsletter about retirement. So why focus on employer coverage? A couple reasons:

Staying employed as retirement comes into view can really help improve retirement security down the road, but health care costs are taking a bigger bite.

If you are 65 or older and still employed, you may be able to choose between an employer plan and Medicare, so it’s important to pay attention to the cost of these options.

More on that second point in a moment. First, let’s look at the details in Kaiser’s authoritative annual study of employer plan trends:

The average annual cost of a health plan covering a family rose 4% this year, to $21,342.

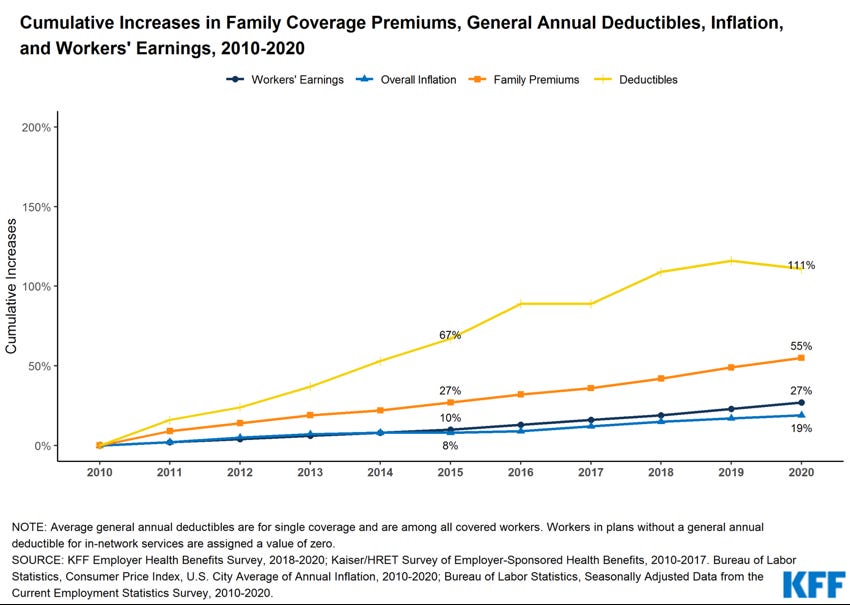

The share of covered workers who pay a deductible has jumped substantially - 83% had a deductible this year, up from 70% a decade ago. The average single deductible was $1,644 up sharply from $917 a decade ago. Taken together, these trends roll up to a 111% increase in the burden of deductibles across all covered workers.

Here’s how this mess looks when you compare trends in premiums and deductibles with inflation and worker earnings:

Ok, back to the Medicare vs. private coverage question.

If you’re in the fortunate group that is still working at age 65 or later, you may have the privilege of a choice between Medicare and employer coverage. If you’re still on your employer’s plan, compare the two options carefully each fall when open enrollment comes around. Certainly weigh the cost- but also the quality of coverage (what is covered and under what terms?).

Another important issue as we age is flexibility - are the doctors and hospitals you want to use included in the coverage? Original Medicare cannot be beat in this category - it allows you to use nearly all health care providers in the U.S. By contrast, most private insurance these days -including Medicare Advantage - are managed care networks that require you to use in-network providers.

Personal circumstances are critical. Do you need family coverage to cover a spouse or dependent children? Does your employer plan include dental, vision and hearing services? Those are not covered under Original Medicare, although many Advantage plans include some level of coverage.

A final point: If you’re still working you may well need to pay Medicare’s high-income premium surcharges, which might make Medicare less competitive by comparison.

Learn more by downloading my guide to transitioning to Medicare (subscribers only).

Final thought: considering the escalating costs, it’s no surprise that employers are showing new interest in expanded Medicare and regulated drug prices.

Not a subscriber yet? Take advantage of a special offer

Sign up now for the free or subscriber edition of the newsletter, and I’ll email a copy of my latest retirement guide to you. This one looks at dealing with the Social Security Administration during the COVID19 crisis.

Customer service at the Social Security Administration has changed during the coronavirus crisis - the agency closed its network of more than 1,200 field offices to the public in March.

Just a reminder- subscribers have access to the entire series of guides at any time. Click on the little green button to subscribe, or go here to learn more.

Timing your retirement

Roughly one-third of workers retire earlier than plan, research shows. The most common causes for unexpected early retirement are health problems and job loss. More Americans are planning to work longer to improve their retirement outlook; in this guide we consider those benefits, and ways to manage late-career work in ways that will help you stay in control of your retirement timeline.

Click here to download my guide to timing your retirement (subscribers only).

Choosing your Medicare coverage

Original Medicare, or Medicare Advantage?

This is the most basic decision you’ll make about health insurance at the point of retirement.

If you opt not to join Original Medicare at that time, you forego the preexisting condition protections offered in Medigap supplemental policies. Medicare Advantage can save you money on premiums, but Original Medicare remains the gold standard for its flexible access to providers and predictability of total costs over your lifetime.

Click here to download my guide to choosing Medicare coverage (subscribers only).

Recommended reading this week

How to evaluate an early retirement buyout offer . . . Health officials scramble to produce Trump's ‘last-minute’ drug cards by election day . . . The pandemic recession has only just begun . . . CDC acknowledges coronavirus can spread through airborne transmission . . . A potential downside of intermittent fasting . . . A retirement rule-of-thumb that won’t work for most people.