How is the pandemic impacting retirement timelines?

One of the most important factors impacting your retirement security is how long you work. Additional years on the job make it easier to boost annual Social Security benefits through delayed filing; working longer also can mean saving more, fewer years of living off those savings and more years of employer-subsidized health insurance.

Many older workers are telling pollsters that they they will need to work longer due to the economic crisis. But for many, that will be no more than wishful thinking, I suspect.

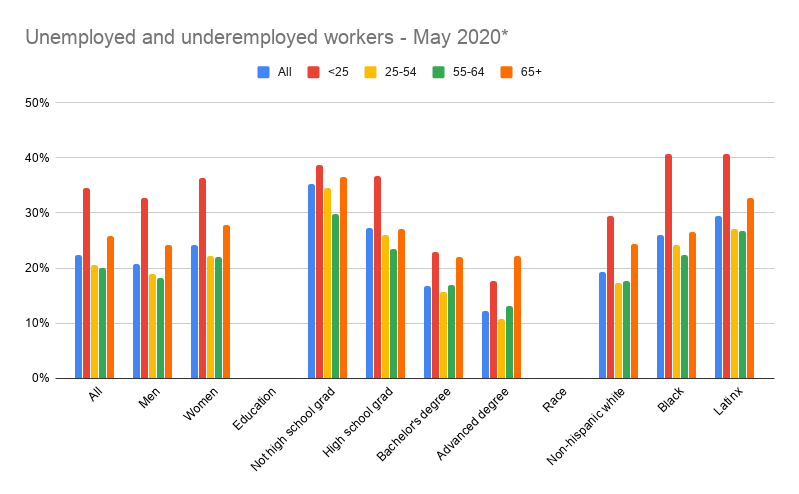

The ghastly jobs picture in May depicted in the chart above tells part of the story. The jobless rates for people over age 65 are higher than any other age group - with the exception of those under age 25 (young workers always have higher jobless rates, as they have less settled careers). The unemployment rates for workers age 55-64 also are very high, as are the rates are higher for older Black and Latinx workers, and for less educated workers.

The other significant factor here is health risk. Older people are not more at risk of coronavirus infection, but some face higher risk of serious illness and death (more on the nuances underneath those numbers below). That is leading to a number of complications for workers and employers as they move to reopen.

In this weekend’s New York Times, I explore how the pandemic likely will impact retirement timelines for older Americans. It already appears to be accelerating a wave of early retirement. COVID19 also will change the conversations that married couples have about their retirement timing.

The pandemic also has sparked new questions for older workers and employers about how to gauge health risk - and some experts worry that age discrimination will make it difficult for them to find new jobs. The down economy itself will be a major obstacle, and there will be some complex issues and problems for employers and workers to navigate around returning to physical workplaces.

For many, the pandemic will mean early filing for Social Security benefits - foregoing potentially higher annual benefits that come with delayed filing. Retirement savings will be converted to emergency funds to keep households afloat.

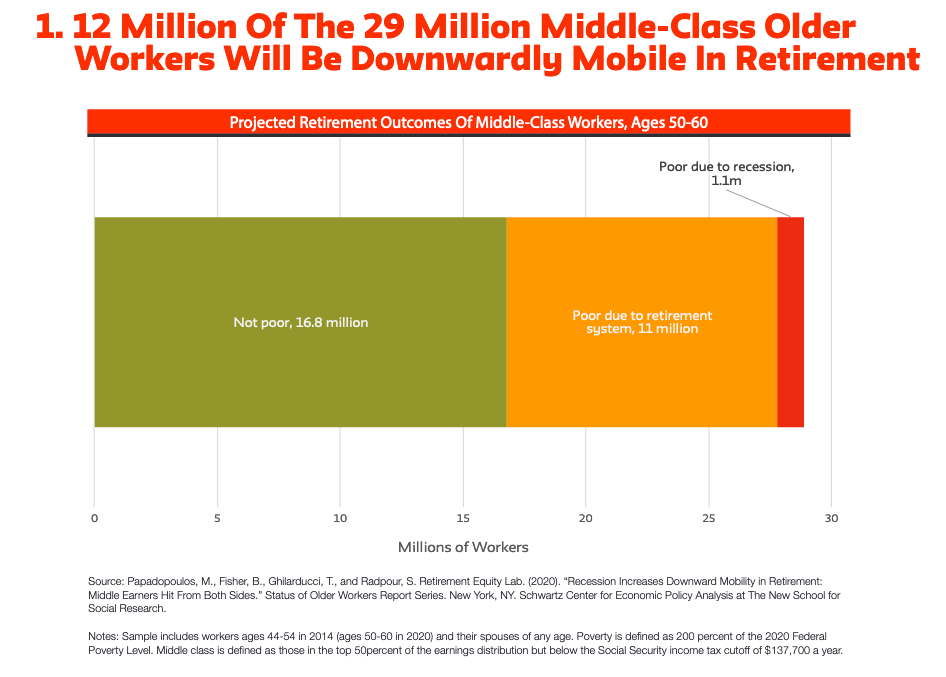

The New School for Social Research forecasts that the poverty rate in retirement among workers now aged 50 to 60 will jump from 28 percent to 54 percent due to the pandemic economic shock.

Guidance from the Centers for Disease Control and Prevention (CDC) states that adults over age 65 are at higher risk of severe illness from COVID19.

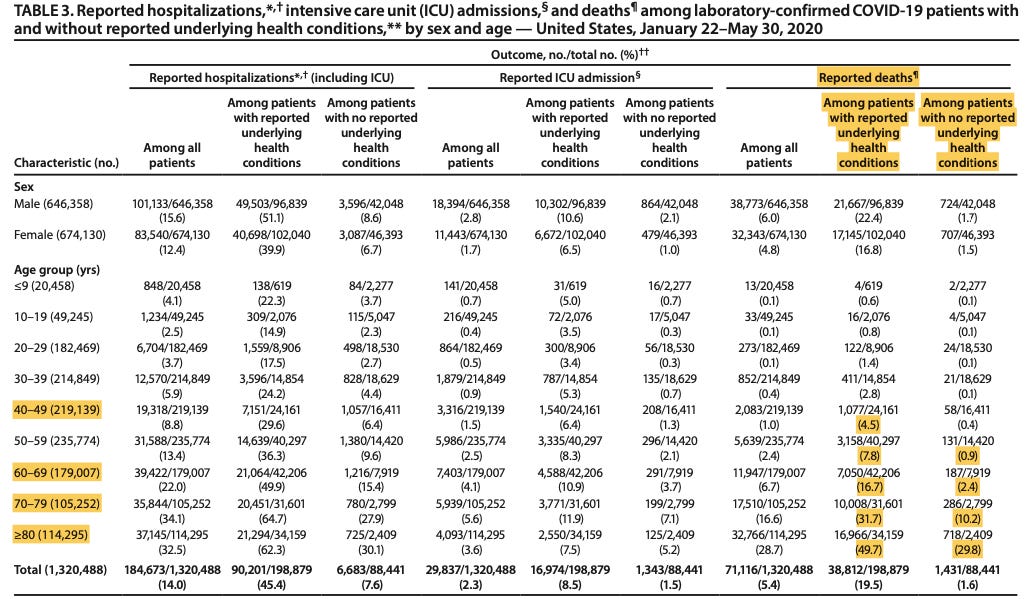

But the underlying CDC data on illness and mortality is more nuanced. It is mostly certainly true that risk is much higher than average for adults over age 70. But for those without underlying health conditions, the risks of severe illness or death for workers in their fifties or sixties who have no underlying health conditions are actually similar or even lower than they are for younger workers in their twenties, thirties, or forties with health problems. For example, for those hospitalized with COVID-19 infection, the CDC reports a death rate of 2.4 percent for people in their sixties without underlying conditions, compared with 4.5 percent for people in their forties with underlying conditions.

(The high risk conditions due to conditions including diabetes, chronic obstructive pulmonary disease, heart disease, obesity, asthma or functional limitations due to cancer.)

Here is the actual CDC data illustrating this point (highlighting added by me). Download the entire CDC brief here.

Data source

Data for the employment figures above courtesy of the Urban Institute, from May 2020 Current Population Survey, Bureau of Labor Statistics.

*This analysis defines underemployed workers as those who are unemployed, including workers who report not being at work for "other" reasons, and workers who report working part-time because they cannot find full-time work.

Podcast

For a heartbreaking look at how pandemic-induced joblessness is impacting average Americans, check out this episode of The Daily from The New York Times, which aired on Wednesday.

A Social Security problem if you’re turning 60 this year

The pandemic-induced recession has created a weird glitch whereby Social Security benefits will be significantly lower for workers who turn 60 this year and are eligible for early retirement benefits in 2022. The glitch also affects anyone becoming eligible for disability or young survivors benefits in 2022.

Paul Van de Water of the Center on Budget and Policy Priorities explains:

Social Security benefits for each new age cohort of retirees are designed to replace about 41 percent of a typical worker’s career-average earnings if one claims benefits at the normal retirement age, which is 67 for those turning 60 in 2020 or later. The benefit formula is progressive: workers with below-average earnings receive a higher replacement rate, and those with above-average earnings receive a lower one. Before computing a worker’s average earnings, Social Security adjusts earnings from years before a worker turns 60 to account for the growth in economy-wide wages, using an “average wage index.”

Normally, average earnings in the economy rise from one year to the next. Due to the sudden, sharp unemployment increase in 2020, however, many workers will suffer a big decrease in their annual earnings. And those decreases will cause the economy-wide average annual wage to fall as well. That, in turn, will reduce the average indexed earnings and Social Security benefits of workers turning 60 in 2020 compared to those with similar earnings who turned 60 in 2019. If the average wage falls by 5 percent in 2020, as now seems likely, the retirement benefit of a 60-year-old worker with average earnings will drop by about $1,200 a year for each and every year of retirement. If the average wage falls more, the decreases will be even larger.

Congress will need to fix this - Van de Water urges lawmakers to take it up in the next pandemic relief bill. One solution, he notes: “One solution would be to specify that the wage-indexing factor couldn’t fall from one year to the next, even when the average wage index declines.”

Not a subscriber yet? Take advantage of a special offer

Sign up now for the free or subscriber edition of the newsletter, and I’ll email a copy of my latest retirement guide to you. This one looks at dealing with the Social Security Administration during the COVID19 crisis.

Customer service at the Social Security Administration has changed during the coronavirus crisis - the agency closed its network of more than 1,200 field offices to the public in March.

Just a reminder - subscribers, have access to the full edition of the weekly newsletter plus the entire series of guides at any time. Click on the little green button to subscribe, or go here to learn more.