Medicare fall enrollment: How to cut through the advertising noise

Plus: News on 2024 Social Security COLA and Medicare premiums

If you’re enrolled in Medicare, you might want to turn off your television this time of year.

In the weeks ahead, the airwaves will be flooded with advertisements promoting insurance plans during Medicare’s open enrollment period, which will start on Sunday and end Dec. 7.

During open enrollment, you can make changes to your Part D prescription drug or Medicare Advantage coverage, and it’s important to review your current selections. Drug plans often change the prices and terms for covering medications — and your needs may have changed in the past year. Medicare Advantage plans can add or remove providers in their network at any time, and many include prescription drug coverage that should be reviewed.

But government officials and researchers have voiced rising concerns about the way these plans are marketed to more than 66 million Americans covered by Medicare, considering the complexity — and importance — of enrollment decisions.

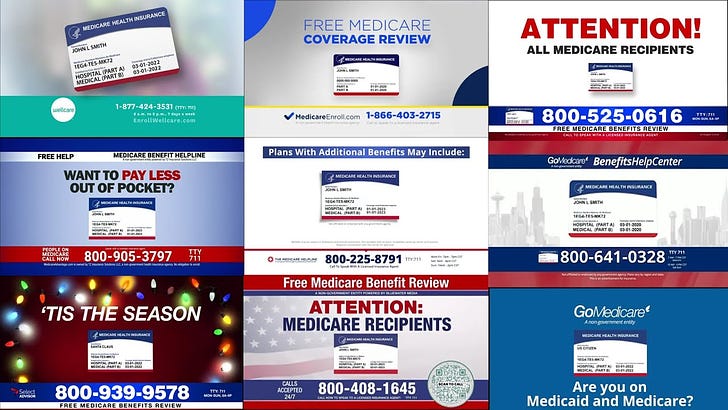

A new study by KFF, a nonprofit organization focused on health policy, examined 1,200 television ads promoting Medicare that aired during the 2022 enrollment season and found that most had promoted Medicare Advantage plans. Drew Altman, KFF’s chief executive, described the blitz as “annual marketing madness” that can confuse and mislead people trying to make complex choices about their coverage.

The marketing practices of health insurers and brokers included improper inferences that the ads are government-sponsored, and messages urging eligible Medicare beneficiaries not to “miss out” on benefits to which they’re entitled, leaving viewers with the incorrect impression that traditional Medicare is incomplete.

The study found nearly 650,000 airings of Medicare ads running during the nine weeks of advertising - more than 9,500 airings per day. Most were sponsored by health insurers, but about 20% ads were sponsored by brokers and other third-party entities, such as marketing firms.

Here’s a sampling of the ads:

Separate research by the Commonwealth Fund, a nonprofit research group focused on health care issues, found that as many as 19 percent of Medicare beneficiaries had reported receiving phone calls or seeing ads that would be considered fraud, including offers of “special discounts” for signing up within a certain time frame. Ten percent reported receiving calls asking for their Medicare or Social Security number before plan details would be given.

The Centers for Medicare & Medicaid Services, which runs Medicare, has moved to strengthen its regulation of plan marketing. Starting with this enrollment season, CMS will require all television ads to be approved in advance and add new messaging standards for all forms of marketing — including direct mail, email and phone outreach.

The effects of the crackdown remain to be seen.

This weekend in the New York Times, I examine the changes you can make to your Medicare coverage during fall enrollment, new federal cost controls on prescription drug plans — and how you can cut through the marketing noise to make smart buying decisions.

Social Security COLA will be 3.2% in 2024

Social Security announced that the annual cost-of-living adjustment (COLA) for next year will be 3.2%.

The COLA reflects the cooler pace of inflation this year, and it comes on the heels of a much larger 8.7% adjustment this year, and 5.9% in 2022. But the Medicare premium increase will put a squeeze on seniors with more modest benefits. And the end of pandemic relief programs will put additional pressure on low income seniors.

Looking at this with a wider lens, it’s important to think of inflation is an ever-present risk that should always be a consideration in your retirement plan.

Last weekend in the New York Times, I explored strategies that can help mitigate inflation risk over the long haul. I discussed the key ideas in that story on Thursday in an interview with CBS News - click the player above to listen.

The key ideas to consider include:

Holding equities in your portfolio, even in retirement, because they have proved to outpace inflation over the long haul.

Delaying your Social Security claim. The Social Security COLA makes it the only true inflation hedge available to retirees — and one of the best ways to maximize that protection is to delay claiming your benefits to increase monthly income.

Consider Treasury inflation-protected securities, (TIPS) and inflation-adjusted mutual funds. TIPS are risk-free if you hold them to maturity, but the road to that end point can be bumpy and the price you’ll pay for the inflation guarantee varies. One approach is a TIPS ladder; low-cost short-term bond funds or a traditional open-end or ETF TIPS funds offer another approach.

But here’s the key point: Inflation really is another form of longevity risk. As Joel Dickson, global head of advice methodology at Vanguard, told me: “If your portfolio going into retirement is projected to be able to satisfy your spending needs for 30 years, an inflation shock might mean that it can only do that for 27 years, and those last three years aren’t being covered.”

Medicare Part B premium will jump in 2024

Following the COLA news, Medicare officials announced that the monthly Part B premium will jump $9.80 to $174.70. That will take a substantial bite out of COLAs, which average $50 for the typical beneficiary. The Part B news came in Medicare’s announcement of all premiums and deductibles for Parts A and B next year. Other highlights:

The Part B deductible will be $240 in 2024, an increase of $14 from $226 this year

The Part A deductible will be $1,632 in 2024, an increase of $32

The announcement also includes the brackets for Income-Related Monthly Adjustment Amounts (IRMAA) next year, which are adjusted annually for inflation.

What I’m reading

Seniors with money to spend are the economy’s secret weapon . . . Time is short, so don’t do things you hate in retirement . . . Many couples don’t coordinate 401(k) matches.