Planning for cognitive decline

A new online tool can help you think through the risks and how to protect yourself and your family.

A growing body of evidence points to the unpleasant fact that our ability to manage our finances declines with age. That’s not to say we’ll all suffer from dementia. But even normal aging reduces the ability to make optimal financial choices—even though our confidence in our own financial decision-making remains high well into old age.

“It’s not that we're necessarily losing all of our marbles,” says Steve Vernon, a research scholar at the Stanford Center on Longevity. “But we are losing a marble or two over time—so the question is, how do we plan for that?”

The Stanford Center teamed up recently with researchers at the University of Minnesota to create an online tool that aims to help answer that question. Called the Thinking Ahead Roadmap: A Guide for Keeping Your Money Safe as You Age, it is an educational and decision-making resource aimed at helping people get a plan in place. Learn more in my latest column for Wealthmanagement.com.

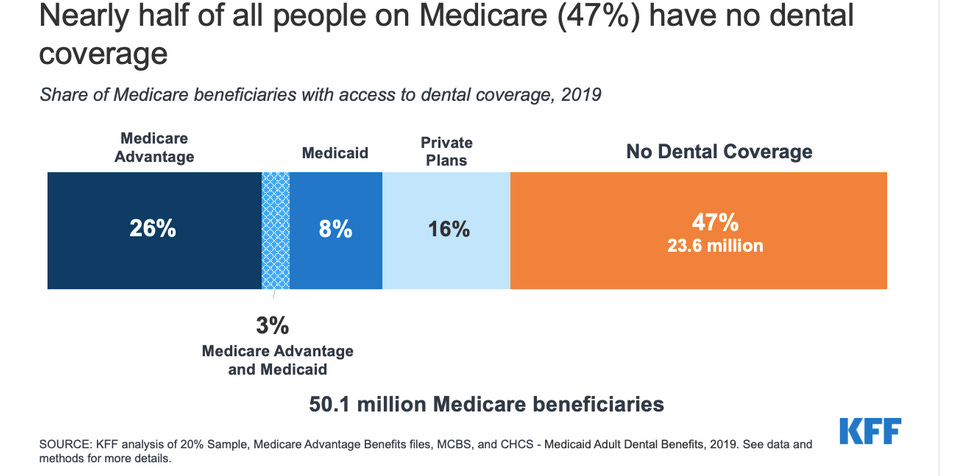

Congress considers adding dental coverage to Medicare

Almost half of Americans enrolled in Medicare did not visit a dentist in 2018. That’s a problem that goes far beyond having white teeth or a beautiful smile - poor dental care can exacerbate serious chronic medical conditions, such as diabetes and cardiovascular disease.

The low frequency of dental visits surfaced in a recent report by the Kaiser Family Foundation. It points to a fundamental gap in Medicare coverage - one that Democrats in Congress hope to close as part of the $3.5 trillion budget reconciliation package now under consideration. The legislation would create a standard benefit in Medicare for dental, vision and hearing care. That would be a game-changer for seniors.

Traditional Medicare pays for dental care only when it is deemed necessary as part of a covered procedure — for example, a tooth extraction needed in preparation for radiation treatment. The program does not cover hearing aids or exams, or most vision care. Most Medicare Advantage plans offer some level of dental, vision and hearing care, but most plans cap annual dollar coverage at levels that will not protect enrollees from more expensive procedures and care.

All three types of coverage are critical to good health. Health researchers have linked poor dental care to higher rates of diabetes, cardiovascular disease and pulmonary infections. And they have found that vision and hearing loss are associated with a higher risk of falls, depression and cognitive impairment.

Learn more in my latest Reuters column; also, see my June column on this topic for The New York Times.

What I’m reading

A terrible time for savers: In an upside-down world of financial markets, expected returns after inflation are at record lows . . . Why ageism in the workplace seems to be okay . . . How an unproven Alzheimer’s drug got approved . . . For older adults, home care has become harder to find . . . Noone wants to live in a nursing home - something’s got to give . . . What I’ve learned over a lifetime caring for the dying . . . For seniors, COVID-19 can be stealthy . . . Imagining a better way to grow old in America . . . Yes, age does make us more generous . . . Social Security judges must resolve 500 to 700 disputes per year. A watchdog says that might be too many.