Retirement success: focus on the paycheck, not a savings number

Steve Vernon is an expert on numbers – but don't ask him for your “number” – that is, the amount you need to save to insure a successful retirement.

In a new book, Vernon lays out a strategy for developing retirement security that begins by thinking beyond your “retirement number.” Instead, he focuses on how to cover basic living expenses by setting up a series of “retirement paychecks” that are guaranteed to last the rest of your life. Any remaining savings are the gravy – use them for discretionary expenses like travel and entertainment.

Vernon worked for years as a consultant to large corporate retirement plans before starting his own California-based firm that provides consumer retirement education. He is a research scholar at the Stanford Center on Longevity, and writes a column for CBS MoneyWatch. In Retirement Game-Changers: Strategies for a Healthy, Financially Secure, and Fulfilling Long Life, he focuses on helping older workers navigate the critical decisions they need to make as they transition from employment to retirement.

The challenges are mounting. Rising longevity, declining availability of traditional defined-benefit pensions and rising healthcare costs make navigating retirement more complicated than it was for previous generations.

But Vernon’s formula is straightforward. “The big picture is to get a feel for what your basic necessities are each month, and your discretionary expenses,” he told me in an interview. “Then, you want to insure an income that exceeds your basic expenses.”

Rosy assumptions on retirement timing invite rude financial surprise

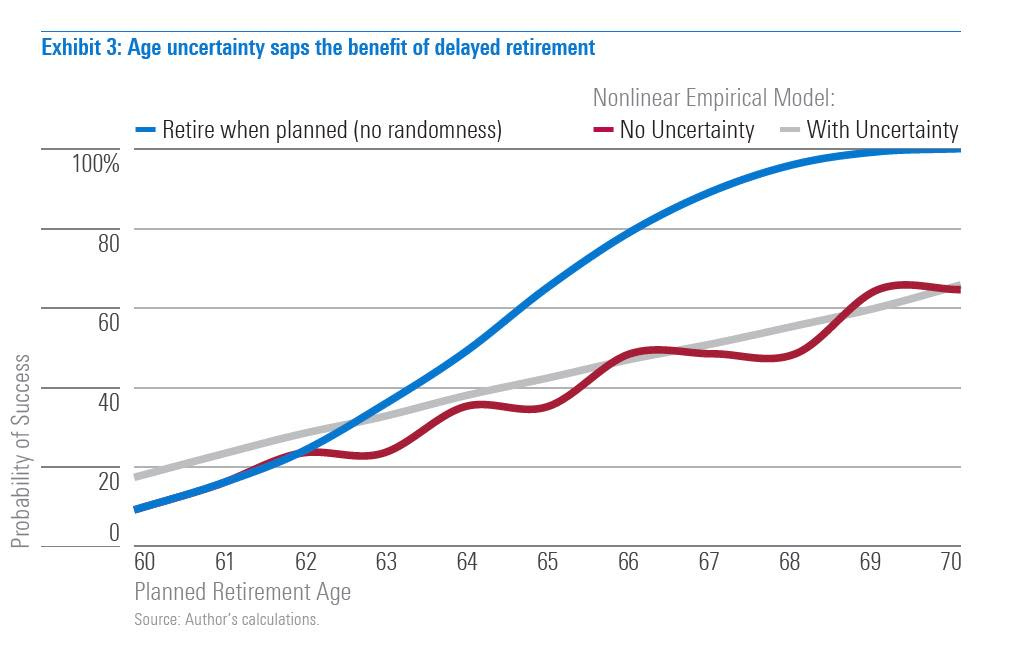

Working longer can boost the odds of a secure retirement – that is an article of faith in retirement planning circles these days.

But many people do not wind up working as long as they expect or hope. And baking in too much optimism about career longevity to your retirement plan can take a heavy toll.

A new research report by Morningstar warns that assumptions about working longer actually can work against you – by considerable margins in some cases – if retirement comes sooner and savings fall short.

“What people are doing is picking unrealistic ages,” said David Blanchett, head of retirement research at Morningstar and author of the report. “You might say that you want to work until 67, but a lot of things can go wrong.”

Most formal retirement plans are built around a specific retirement age. But health problems, job loss or just plain burnout often produce a different outcome. Blanchett found that for anyone planning to retire after age 61, the chances of meeting your income and standard-of-living goals can fall sharply if you do not work at least to that age.

The chart below from Blanchett’s report illustrates the problem:

Elsewhere around the web . . .

The SEC issued a new warning about fraud and crypto-currencies in IRA accounts. I wrote back in March about the growing amount of crytpo-currenty marketing pitches directed at IRA, and why it’s best to stay away . . . A same-sex couple has sued a retirement community for refusing them admission, charging housing discrimination. Paula Span writes in The New York Times that the St. Louis-area retirement home actively recruited Mary Walsh and Beverly Nance until it learned about the nature of their relationship.

Tweet of the Week

We know @CMSGov should and could be doing more to help people with #Medicare access medically necessary dental care. Your member of Congress can help convince the agency they need to act. See here for more information https://t.co/ATp5FUaEzi #MedicareDental

August 16, 2018

We know @CMSGov should and could be doing more to help people with #Medicare access medically necessary dental care. Your member of Congress can help convince the agency they need to act. See here for more information https://t.co/ATp5FUaEzi #MedicareDental

August 16, 2018R.I.P to the Queen of Soul

Watch Aretha Franklin's iconic performance at Pres. Obama's 2009 inauguration. https://t.co/xGpF3HEB0q pic.twitter.com/HSzdrfjx9U

August 16, 2018