Returning to work after an unexpected early retirement? Adjust your plan

Many older workers who retired due to COVID-19 are now re-entering the workforce. Social Security and Medicare benefits should be revisited.

The Great Retirement is morphing into the Great Return, with the employment report for March showing a jump back into the labor force among older workers. That reflects the plentiful number of available jobs - and reduced concerns about the health risks associated with COVID-19.

The pandemic forced millions of older workers into early retirement, causing many to stop saving and claim Social Security earlier than planned. This robbed them of the opportunity to boost their monthly benefits down the road through a delayed claim.

Working longer is a great way to bolster income in retirement. But if you count yourself among the “back to work” crowd, your retirement plan may need an adjustment - especially enrollment in Social Security and Medicare.

Learn more in my Reuters Money column.

Social Security and inflation

Inflation has jumped back into the headlines for the first time in several decades—and it’s difficult to predict when consumer price increases will slow down, considering the economic disruptions caused by war in Ukraine, unstable energy markets and the ongoing pandemic.

Retirees naturally worry about how inflation will affect their spending power —and true inflation protection is difficult to find without taking questionable investment risks. But there is one exception: Social Security. It’s the only component of our retirement income system built to provide risk-free, automatic inflation protection.

Unlike defined contribution plans and private sector defined benefit plans, Social Security benefits adjust annually to mirror consumer prices—and wage growth also factors into the benefit formula and the system’s finances.

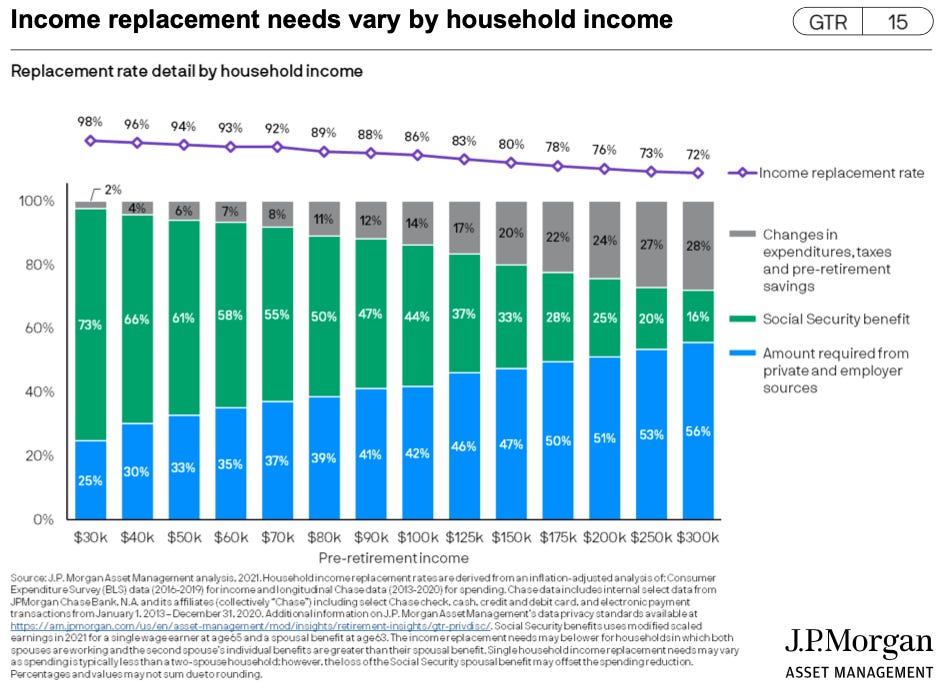

Higher-income retirees sometimes are surprised to lear just how large a component of retirement income Social Security will be for them. J.P. Morgan Asset Management calculates that for a retiree who needs to replace 80% of a $150,000 pre-retirement income, Social Security covers 33%.

That’s a lower replacement rate than lower-income workers can expect but still an important counterweight against inflation. And, it’s a great argument for making Social Security as large a component as possible in your client’s plan by delaying their claims to boost monthly income.

In my Wealth Management column this month, I take a look at the history of Social Security inflation adjustments, and how higher payouts impact the program’s finances (spoiler alert: not much).

Who will take care of aging boomers?

The U.S. population is aging rapidly, and most of the elderly population reports that ht hopes to “age in place” - that is, remain in their homes and communities as long as possible. The converging trends point toward a profound shift in caregiving needs, but there are huge questions about who will provide the needed care. Will it come from adult children, or a professional workforce that is disproportionately foreign-born? For the roughly one-third of seniors that will need institutional care at some point, how will adequate staffing be sustained?

The Brookings Institution recently brought together leading researchers to present their findings on the role of immigration in caregiving, followed by a panel discussion among experts on immigration and health care. View the webinar below; also see this recent public radio story on how low wages and high costs clash in the home health care crisis for aging Americans.

What I’m reading

Dying for care: How pervasive failures in the eldercare business escaped notice in the pandemic . . . When parents are lost to COVID-19, grandparents step in . . . Returning to the office is harder when you’re taking care of mom or dad . . . Inventor of the 4% drawdown rule now recommends a more conservative approach . . . The safe investment that will soon yield almost 10% . . . Developers bet that boomers will want urban living in retirement . . . Calling a stroke a stroke - why transient ischemic attack is misleading name . . . How to communicate with Alzheimer’s patients . . . What bond types provide the most diversification for stock investors?