Revising the RMD rules - what's that all about?

Trump Administration orders a review of retirement account mandatory withdrawal tables; House GOP proposes partial repeal

This is a sample edition of the subscription RetirementRevised.com newsletter. I hope you’ll consider subscribing - learn more about the newsletter and sign up here!

With best regards,

Mark Miller

Revising RMDS - what’s that all about?

When you reach a certain age - 70.5 - you must start withdrawing funds from tax-deferred 401(k) and IRA accounts - the dreaded required minimum distribution, or RMD. Many retirees find the RMD rules burdensome, and a surprisingly large percentage would prefer not to draw down funds at all. Ideas have been rattling around for a while now to reform the RMD rules, and President Trump signed an executive order late last month that calls for a review of the formulas used to determine RMD amounts. Meanwhile, the latest tax cut proposal from House GOP leadership unveiled this week (a.k.a. “Tax Reform 2.0”) calls for repeal of RMDs on accounts with $50,000 or less.

What’s this all about, Alfie?

First, a refresher: when you reach age 70-1/2, a certain amount of your tax-deferred savings in IRAs and most 401(k) accounts must be drawn down every year under the RMD rules. Income taxes must be paid on the withdrawn funds, and RMDs also can trigger additional taxes on Social Security income and even high income Medicare premium surcharges. Missing an RMD leaves you on the hook for an onerous 50 percent tax penalty, plus interest, on the amounts you failed to draw on time.

The executive order directs the U.S. Treasury to consider whether the tables should be revised in light of rising longevity - the life expectancy tables were last revised in 2002. Average life expectancy for men from age 70 has risen 2.1 years for men since 2000, and 1.6 for women, according to the Society of Actuaries. That means any revisions likely would have a very small impact on the amounts average retirees must withdraw - no more than a few hundred dollars annually in most cases. As Howard Gleckman of the Tax Policy Center explains, the revisions would mainly impact wealthier households:

Nearly half of American retirees say they have less than $100,000 in retirement savings. Many low- and moderate-income retirees already withdraw more than the legal minimum to help pay living expenses. They would not benefit at all from potential changes to the rules.

The biggest share of defined contribution retirement assets are in the hands of a relatively few high-income households. Those who use big-dollar retirement accounts as estate planning vehicles would the real winners from the changes Trump is suggesting.

Gleckman goes on to calculate the likely tax savings for average households - and comes up with a whopping $27.60. The calculation:

Assume you have $274,000 in an IRA (far more than average). And assume Treasury adds 1.6 years to its life tables. Instead of having to withdraw $10,000 annually (1/27.4th), you’ll need withdraw only $9,448 (or 1/29th). If you are in the 25 percent tax bracket, your annual tax savings will be $138 ($2,362 instead of $2,500). If you have $137,000 in your retirement plan and are in the 10 percent tax bracket, your annual tax savings would be $27.60.

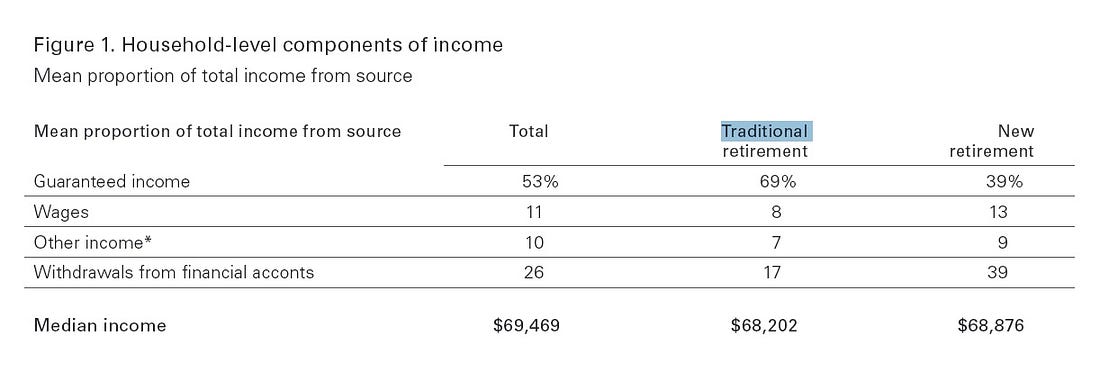

But tax savings may not really be the key point here. Some research suggests that many retirees retain surprisingly high percentages of their savings well into retirement. A 2016 Vanguard study looked at withdrawals from all financial accounts among wealthier households. It found that among wealthier households, the median withdrawal rate from financial accounts was a modest 3 percent. As a share of retirement income, saving drawdowns varied from 17 percent among households with defined benefit (DB) pensions and high Social Security benefits to 39 percent for households more reliant on savings (that is, without DB pensions):

Some proposals for reform of RMDs would go further than reviewing the longevity assumptions, as per the executive order. This week, House Republicans called for elimination of RMDs from accounts with $50,000 or less as part of a broader Tax Reform 2.0 package. The bill’s chances to become law before the mid-term elections seem slim, Reuters reports. (In 2015, the Obama Administration made a similar proposal in 2015, calling for elimination on RMDs in accounts up to $100,000.)

IRA expert Ed Slott has called for eliminating RMDs altogether, or boosting the age when they kick in dramatically, to age 80. Here he is arguing the case in The Wall Street Journal (subscription required):

Age 70½ certainly isn’t the new 40, but it’s far too young to be forced to take mandatory withdrawals from IRAs and other tax-favored retirement accounts.

The government should raise the age for required minimum distributions to at least 80—if not eliminate it altogether—to more accurately reflect today’s increased longevity, as well as the likelihood that many baby boomers will continue working well into their 70s. (Look no further than our president, who at 70 is showing no signs of slowing down.)

RMDs are particularly onerous for seniors who still have employment income and don’t need to tap savings for living expenses. Under current rules, they can delay withdrawals from their current employer’s retirement plan, but not from IRAs or plans sponsored by former employers.

No one should be forced to pull money out of an IRA while they are still working. When combined with a paycheck, these distributions can substantially increase taxable income. Some seniors will be bumped into higher tax brackets as a result, and they could see tax deductions and other benefits tied to income levels reduced, resulting in a higher overall tax bill that prematurely eats away at retirement balances.

Raising the RMD age to 80 could help solve this problem, since fewer seniors are likely to be working then. But even people who aren’t working in their 70s would benefit from an increase in the RMD age in that it would give them more time and flexibility to plan withdrawals in a way that better complements their tax, financial and estate-planning goals.

The IRS uses the longevity assumptions to determine a distribution factor. If you’re curious about how the current assumptions work, see IRS Publication 590-B - scroll down to Appendix B (Uniform Lifetime Table). Divide your account balance by the “distribution period” to determine what you must draw down in any given year (helpfully, the IRS calculates these factors all the way to age 115!)

Addressing the small business 401(k) deficit

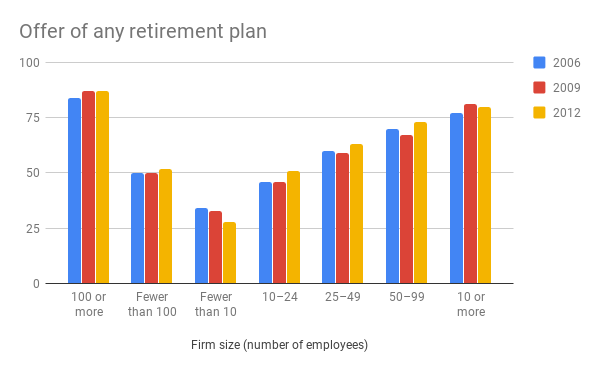

The president’s executive order also directed the government to consider ways to liberalize rules governing “open multiple-employer plans,” (MEPs). The idea here is to make it easier for small employers to offer 401(k) accounts to workers by reducing cost and administrative burden. At present, MEPs can be offered only to companies in the same industry or profession; the executive order directs the U.S. Department of Labor and the U.S. Treasury to issue new rules making it easier for small businesses from diverse industries to join open MEPs.

Data shows that workers at very small businesses are far less likely to be offered a 401(k) plan than their counterparts at larger companies, as this data from the Social Security Administration shows:

Open MEPs are the conservative answer to the coverage problem. A growing number of states have been tackling the small-business coverage problem via a different route, creating government-sponsored auto-IRA plans. In most cases, employers above a certain size are required to set up automatic payroll deduction for workers. Employers are not required to make matching contributions or to administer the plans.

Major business organizations representing the financial services industry have been pushing open MEPs aggressively, in part as the alternative approach to the state-sponsored plans, which they view as inferior to the 401(k) plans they operate for employers. And the Trump administration backed them up. Last year, it successfully promoted legislation that reversed an earlier Labor Department rule that established guidelines for state and local governments to set up the plans.

IRS warns retirees on avoiding April tax surprises

The Internal Revenue Service has issued a warning to retirees who are risk risk of tax penalties for not paying the right amount of tax on pension and IRA payouts under the new rates set by the new tax law (the Tax Cuts and Jobs Act).

The Tax Cuts and Jobs Act increased the standard deduction, eliminated personal exemptions and limited certain deductions, including the state and local tax deduction. Your taxes may have gone up or down, so you may need to revise the amount of taxes withheld from pension income - or any quarterly estimated payments that you make. Ashlea Ebeling of Forbes offers this helpful explainer.

The future of retirement planning belongs to the . . .

The future of retirement planning belongs to the . . .

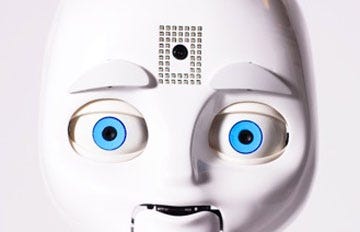

Who will help you plan for retirement - a robot or a cyborg?

Pundits have been saying for some time now that the future belongs to the “robo-adviser” - automated portfolio services that use algorithms to manage investments. The robo-services have attracted interest as a way to deploy low-cost advice, but some experts think the real winners will be “cyborgs” - human advisers aided by advanced technology. Portfolio management is becoming a commodity; advisers will add value by helping clients think through more complex questions. Michael Kitces, director of wealth management for Pinnacle Advisory Group and publisher of the widely followed Nerd's Eye View blog put it to me this way in an interview last year:

“We can be navigators of uncertainty and explorers of alternatives - what happens to my plan if I retire sooner? What if I want to work in retirement, or find a new career? Technology doesn’t do that, but it can facilitate the conversation if I can use technology to paint the picture for clients.”

Tara Siegel Bernard notes in a new story on this topic for The New York Times that a growing number of online portfolio services are growing by “adding warm-blooded financial planners to the mix, often at less than half the cost of what a traditional adviser charges.”

Growing risk: Eviction from assisted living facilities

Across the country, assisted living facilities are evicting residents who have grown older and frail, reports Judith Graham of Kaiser Health News:

Evictions top the list of grievances about assisted living received by long-term care ombudsmen across the U.S. In 2016, the most recent year for which data are available, 2,867 complaints of this kind were recorded — a number that experts believe is almost surely an undercount.

Often, there’s little that residents or their families can do about evictions, Graham reports. Assisted living is governed by states, and regulations tend to be loosely drafted, allowing facilities considerable flexibility in determining whom they admit as residents, the care they’re prepared to give and when an eviction is warranted.

Welcoming diverse new voices on aging

On September 20th, Encore.org welcomes 20 thought leaders in the field of aging to a year-long fellowship aimed at amplifying their voices through writing and speaking. They are the first cohort of the Encore Public Voices Fellowship.

Encore Vice President Marci Alboher reports:

These leaders will not be focusing on aches and pains or anti-aging tips. They are all working on solutions-oriented approaches to a guiding question: What needs to happen to allow everyone to find purpose and engagement in the second half of life?

The 20 fellows are diverse in many ways. They range in age from millennials to the Greatest Generation. They come from urban and rural communities, both inside and outside of the United States. They are nonprofit and faith leaders, academics, business people, housing innovators, and community activists. More than half are people of color. And more than half are women.

Challenges that the fellows are taking on include inter-generational housing, climate change, ageism, racial and religious reconciliation. Learn more.

IRS approves 401(k)-style student debt benefit

The IRS approved a new type of tax-deferred employee benefit aimed at helping workers pay off student debt. The program in question was run through an employer’s 401(k) plan; the IRS didn’t name the company in question, but Abbott Laboratories confirmed that it was the employer that had requested and received the ruling, according to IRA expert Ed Slott, writing in Financial Planning:

Abbott’s 401(k) plan allows pre-tax, Roth and after-tax contributions and provides a matching contribution. If the employee contributes at least 2% of compensation into the plan, the company makes a matching contribution equal to 5% of compensation. If an employee doesn’t contribute to the plan, he or she does not get the employer matching contribution.

This seems like a smart idea. Student debt nearly tripled in real terms from 2005 to 2017, putting a damper on retirement savings. We’re also seeing an increase in the amount of debt households are carrying into retirement. Programs like Abbott’s fit with rising employer interest in financial wellness for employees. I wrote recently about another example of this - employer efforts to help employees build liquid emergency savings.