The Inflation Reduction Act's impact on retirees

The legislation makes the most significant changes to Medicare in almost two decades.

The climate and healthcare bill that President Joe Biden signed into law Tuesday marks the most significant changes to Medicare since the Part D prescription drug benefit was enacted in 2003.

The Inflation Reduction Act of 2022 aims, in part, to address the skyrocketing cost of prescription drugs—and in some respects, it is a do-over that fixes the flaws in the Medicare Modernization Act of 2003.

That law contained a controversial provision that prohibited Medicare from using its huge purchasing clout to negotiate drug prices with pharmaceutical makers. It’s therefore no surprise that the big headline on the Inflation Reduction Act is that it will finally empower Medicare to negotiate with drugmakers on the prices of a shortlist of the most expensive drugs, starting in 2026.

AARP released a list of high cost drugs that it expects will be negotiated under the new law:

Here’s another key feature of the new legislation: Starting in 2025, the maximum Part D out-of-pocket liability will be $2,000. That change may contribute even more to protecting enrollees from soaring costs

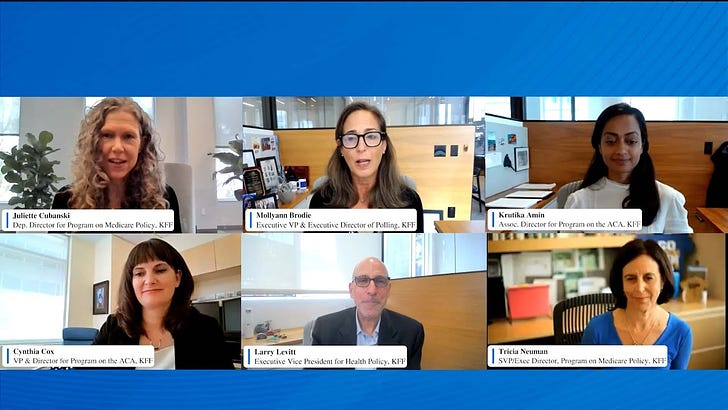

If you’d like to learn more about the new law, listen to this excellent webinar convened last week by the Kaiser Family Foundation. Speakers included several of KFF’s top experts on Medicare.

Over-the-counter hearing aids coming this fall

There was good news this week for people with hearing problems: the F.D.A. gave final approval for over-the-counter hearing aids, starting as early as October.

This change will unleash a wave of low-cost innovation in hearing aid products. Apple, Bose and other consumer electronics giants are poised to introduce new offerings shortly.

What I’m reading

Seven ways to make younger friends in retirement . . . Big changes are coming in health care costs . . . Health care bill will bring peace of mind . . . Big Pharma went all in to kill drug pricing negotiation . . . Retirees save money by taking part-time work in the travel industry . . . . The tricky math of retiring in a market downturn . . . Hospices have become big business for private equity firms . . . Public pension funds have been stung by the crypto crash . . . Baby boomer face a spike in homelessness.