Welcome to the new RetirementRevised newsletter!

Dear RetirementRevised.com subscriber -

If this week’s newsletter looks a little different, there’s a good reason. I moved it to Substack, a fast-growing platform for small online publishers.

This marks the start of a new phase of my work as an independent journalist, and I’m really excited about it. When I started RetirementRevised a decade ago, the online ecosystem was very different. The predominant publishing model was online advertising coupled with free email newsletters. But that model, I’m convinced, is broken - it just does not work for small online publishers in an online market dominated and controlled by Google, Facebook, Twitter and giant news outlets.

This newsletter will continue to arrive in your in box at no charge. Later this year, I plan to add a new subscription option that will offer new ways for us to interact and for me to serve your information needs. When that comes around, I hope you will give it a try.

Meanwhile, my mainstream media work covering retirement and aging continues. As you may know, I write a weekly column for the Reuters news service, contribute regularly to Morningstar.com and WealthManagement.com and write occasional pieces for The New York Times and the AARP magazine. (You can always follow me on Twitter or Facebook.) My second book was published earlier this year - Jolt: Stories of Trauma and Transformation. I’m already starting to sketch out the next book project.

Best regards,

Mark Miller

Now, on to this week’s news . . .

Medigap preexisting condition protections could use some strengthening.

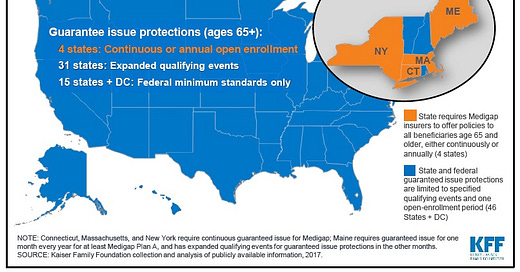

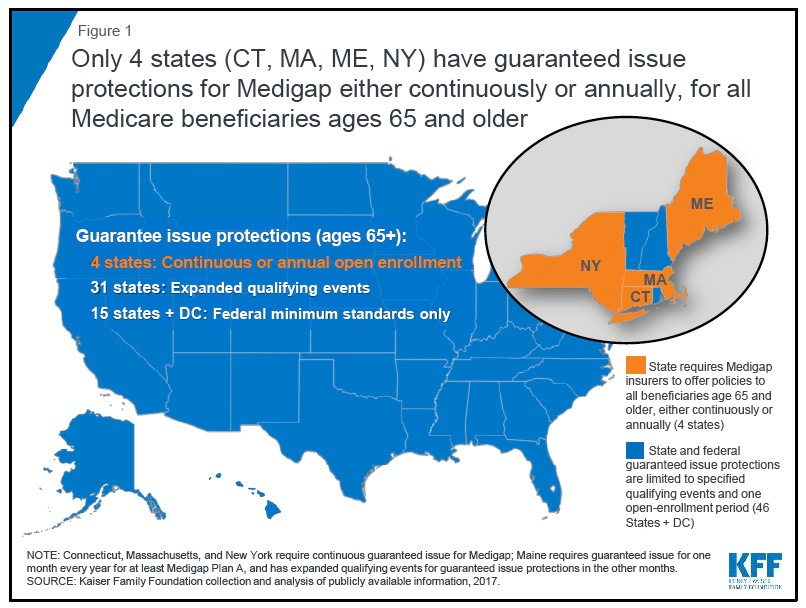

Medigap policies fill gaps in coverage for people enrolled in traditional fee-for-service Medicare, such as co-pays, deductibles and limits on hospitalization benefits. Federal law provides some baseline protection against so-called medical underwriting, and some states regulate it further. But these additional protections can vary widely from state to state, according to a new study by the Kaiser Family Foundation (KFF).

As KFF’s Tricia Neuman notes, the complications on Medigap signup speak to the importance of thinking through the initial choice of traditional fee-for-service Medicare versus Medicare Advantage:

Heads up prospective Medicare beneficiaries. Here's another thing to consider if you are choosing between a Medicare Advantage plan or traditional Medicare with additional Medigap protection @KaiserFamFound https://t.co/S6aNm3Zn1A pic.twitter.com/kU7oDwd3Td

July 16, 2018The tax law has made this charitable giving option much more interesting.

Giving away money from your IRA is looking like a better bet than ever.

Well, perhaps not just giving it away, but donating to a charitable cause. The qualified charitable distribution (QCD) permits IRA account owners of a certain age to use IRAs to make direct charitable contributions up to $100,000 annually. If you are charitably minded and older than 70 1/2, QCDs offer a tax-sensible route to giving after passage last year of the Tax Cuts and Jobs Act.

Listen to the best chat I’ve had so far about my new book

Tweet of the week

Agriculture uses 40% of land on earth, more than any other human activity—& we waste so much of the food we grow. It’s time to rethink our food system by curbing food waste, eating differently & farming more sustainably. See simple things you can do: https://t.co/jPLofZskOl pic.twitter.com/hPf9mcrUFH

July 15, 2018