The old line that “you can’t take it with you” doesn’t apply when it comes to your 401(k).

When you change jobs or retire, you have three basic choices: leave your retirement account where it is, roll it over to a new employer or move it to a standalone individual retirement account (IRA).

IRAs have been gaining ground. The share of the retirement market held in IRAs jumped from 31% to 38% in 2021, according to a recent report by Cerulli Associates. The research and consulting company expects that figure to rise further, to 41% percent by 2027, with most of the growth coming from rollovers.

When does it make sense to leave a 401(k) plan behind? I get into the pros and cons in my latest column for Reuters. The answer really depends on the quality of your workplace plan, and whether it’s a good fit from an investment standpoint.

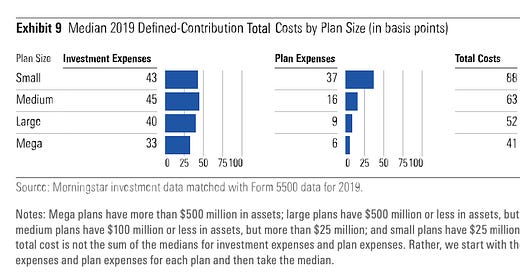

Most important, pay attention to the fees you’ll pay over time, either in a 401(k) plan or IRA. A study by Morningstar found that average total costs paid by sponsors and participants in workplace plans varied widely; some plans charge as little as 0.1% against your assets, and some have total costs over 3%. These higher rates are usually found among small employers.

Just take a look at this Morningstar breakout of total costs (righthand column) and how they vary from small to large plans:

Fees also vary in IRAs, of course. Research published last year by the Pew Charitable Trusts found that investors potentially can lose thousands of dollars over time in IRAs owing to what might seem like small differences in total expenses - especially the cost gap between retail and institutional shares. But it’s very possible to roll over to a very low-cost IRA. Pew also published an IRA fee calculator that can illustrate the impact of fees on your savings over time.

Also interesting: Three large 401(k) administrators banded together to make it easier for workers with small accounts to transfer the money to their new employers’ plans.

Retirement Reboot is Terry Savage’s pick as best book you can buy” right now on retirement planning!

I was thrilled to learn that nationally-syndicated personal finance columnist Terry Save picked Retirement Reboot as her “best book you can buy today about personal financial planning for retirement” for 2023.

Terry’s nod puts me in some very good company - her pick last year was Money Magic: An Economist’s Secrets to More Money, Less Risk and a Better Life” by economist Larry Kotlikoff; two years ago it was "The Price You Pay for College" by Ron Lieber of the New York Times.

Here’s an excerpt from Terry’s comments about Retirement Reboot:

This book is more than a pep talk about the possibilities of enjoying your later years. It’s filled with practical advice on negotiating those critical decisions about when to take Social Security (yes, later is better!), deciding between traditional Medicare and Medicare Advantage, and tapping your home equity through a reverse mortgage or downsizing. And Miller guides you gently into the one topic most pre-retirees want to ignore: the potential need for — and cost of — long-term care. He explains the affordable choices.

Miller urges that it is never too late to build some retirement savings — even if you don’t get started until after the kids are out of college. He has advice on maximizing retirement contributions later in life as well as investment products such as target-date funds (which are not all alike, even though they have the same target year). Equally helpful is his advice in finding a financial adviser you can trust.

I found myself nodding in agreement with Miller’s conclusions and appreciating his ability to make this information accessible and useful. I guess it comes down to this: "Retirement Reboot" is the best book you can buy today about personal financial planning for retirement. And that’s The Savage Truth.

Thanks, Terry!

Retirement Reboot in the News: I joined Jill Schlesinger on her CBS Radio program Jill on Money. Talking with Jill is always fun, and we had a lively conversation. You can find the interview here in two parts - scroll down the page a bit . . . On the Advisor Innovations podcast, I chatted with David Armstrong, executive director of WealthManagement.com . . . I spoke with Dan Doonan of the National Institute on Retirement Security about Retirement Reboot in this Q&A. I’ll be giving a keynote talk next Tuesday at the NIRS annual conference.

Retirement Rebootcast: The entire series is online now

The six-part podcast series on the key themes of my new book is now online. I hope you’ve enjoyed all of these conversations with experts on key retirement topics, but in case you missed any of them, here are links. You can also subscribe on Apple Podcasts or Spotify (search “Retirement Revised”).

You’ll find engaging discussions on the importance of making a plan for retirement, optimizing Social Security, navigating Medicare and much more.

In case you missed it: How the political parties would address Social Security and Medicare challenges

Last weekend in the New York Times, I took a close look at the plans spelled out by Democrats and Republicans for addressing the financial challenges facing Social Security and Medicare. Most Democrats are unified behind proposals that would raise new taxes on the wealthy and expand benefits; Republicans are less united, but conservatives have outlined changes that would shrink benefits and reduce eligibility.

What I’m reading

Why Social Security and Medicare are sustainable . . . Nursing home operators drained cash while residences deteriorated . . . Relocating in retirement to care for a grandchild isn’t unusual . . . More parents are moving in with adult children, and at a younger age.