Yes, Social Security and Medicare are on the ballot this year

I’ve long wondered when Social Security and Medicare would become issues in a presidential race. For years, public opinion polling has shown broad support across party lines and all demographic groups for keeping these programs strong, and advocacy groups have tried their hardest to get candidates and voters focused on their future.

It really hasn’t worked - until this year.

In August, President Donald Trump put Social Security in play - intentionally or not - by signing a presidential memorandum calling for the deferral of Federal Insurance Contributions Act (FICA) revenue through year-end as a pandemic relief measure - and he also said he would push for termination of the tax. I’ve argued this could be a big deal - if Trump gets his way, and if FICA is not replaced with something else, the program would run out of money very quickly. Congress would need to come up with about $1 trillion annually to keep the program whole. What odds would you give that?

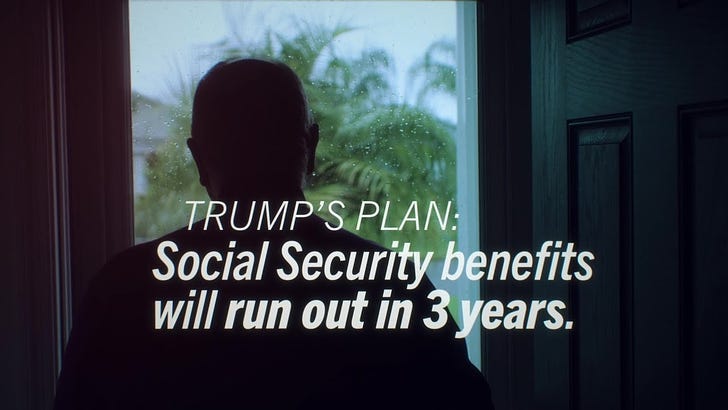

Social Security advocacy groups and the Biden campaign have jumped all over this plan, running a series of tv ads quoting an actuarial opinion letter on Trump’s proposal from Stephen C. Goss, Social Security’s nonpartisan chief actuary. The letter contains the bombshell forecast that in this "what if?" scenario, Social Security’s Disability Insurance trust fund would be drained next year, and the Old Age and Survivors trust fund would be emptied in 2023. Biden them promises to protect Social Security and keep it strong.

Here’s an example:

But FICA isn’t the only retirement policy issue on the ballot this year - in fact, it’s not even the most important one.

Social Security’s trust funds face long-term solvency problems, and the Medicare Hospital Insurance trust fund is on track to be exhausted in 2024.

Meanwhile, the future of the Affordable Care Act is on the line at the U.S. Supreme Court. The ACA has been especially beneficial for older, pre-Medicare Americans - especially the guarantee of coverage for people with preexisting conditions, premium subsidies and access to Medicaid in many states. Coverage rates for this age group have since improved dramatically under the ACA - in 2018, 8.8% of adults ages 50 to 64 were uninsured, a decline from 14% in 2010, according to the Commonwealth Fund.

I dive into all this in my column this week for Reuters.

Not a subscriber yet? Take advantage of a special offer

Sign up now for the free or subscriber edition of the newsletter, and I’ll email a copy of my latest retirement guide to you. This one looks at dealing with the Social Security Administration during the COVID19 crisis.

Customer service at the Social Security Administration has changed during the coronavirus crisis - the agency closed its network of more than 1,200 field offices to the public in March.

Just a reminder- subscribers have access to the entire series of guides at any time. Click on the little green button to subscribe, or go here to learn more.

Legislation caps possible Medicare Part B premium spike for next year

The short-term government funding bill signed into law this week by President Trump includes a provision that would cap any increase in the Medicare Part B premium at 25% of what it otherwise might have been. It’s difficult to know at this point what the impact of this will be - the Part B premium generally is announced in November. And, the premium increase interacts with the Social Security cost-of-living adjustment; we won’t know that figure for a couple weeks yet.

But the Medicare trustees had been forecasting a 6% increase in the standard Part B premium for 2021 - and that was before the pandemic. (This year, the standard premium is $144.60) So this new legislation should provide some protection against a sizeable increase during a very difficult economy.

That’s a short-term fix at best, as noted by Mary Johnson of the Senior Citizens League. She offered this comment via email:

While restricting a potential Part B spike in any given year is good news for beneficiaries, the problem itself isn’t going away any time soon, because of the low overall growth in Social Security COLAs and corresponding benefits that we've experienced now since 2010. Medicare Part B premiums are simply growing too fast, and so far putting a lid on those costs has evaded Congress.

Unless Congress acts to boost SS benefits and finds a better way to adjust benefits for growing Medicare costs, this problem of needing to find alternate sources of funding for Part B premiums will continue to occur with greater frequently in the future. This approach of restricting and then imposing future premium repayments is like a payday loan. It just makes the premiums grow faster and the problem is triggered again when COLAs are extremely low.

Separately, President Trump is promising to mail seniors a $200 prescription drug discount card. Stay tuned.

A community-based approach to financial literacy

Most financial advice is geared toward people with enough assets to own a home, save for their children’s college education and contribute to retirement accounts. The advice often isn’t useful for lower-income individuals and families. Yet the goals are the same: To own a home; start a business; pay for education; and achieve financial security.

Too many people assume that lower-income individuals and families aren’t smart with their money--or so we’re told. In a new podcast from Minnesota Public Radio, co-hosts Chris Farrell and Twila Dang explore why that line of thinking is wrong - in fact, deeply wrong. Here’s how they describe the podcast’s focus:

“The evidence is compelling that lower-income individuals and families know where every penny is going. People with low and unstable incomes are often creative and collaborative with their finances.

These ideas are behind small change: Money Stories from the Neighborhood. The podcast takes a different approach to financial literacy. Instead of talking to experts, we went into communities and learned from individuals with direct experience living with low and unstable incomes.

The stories we heard were inspiring, clever and sometimes heartbreaking. The advice we were given was creative, collaborative and practical.

The biggest theme that emerged from the conversations. The importance of community--people coming together to help each other achieve their financial goals.”

Recommended reading this week

As seniors find themselves cut off from loved ones during the pandemic, some are turning to automated animals for company . . . Why Trump has no real health plan . . . Over the next decade, the number of elderly homeless Americans is projected to triple . . . People with extra weight may struggle to mount a robust immune response to the coronavirus — and may respond poorly to a vaccine . . . Trump tax-return report fuels Democrats’ crive to tax the rich and beef up IRS enforcement . . . What is a pre-existing condition and how many people have them?