We’ve been devoting time on the podcast lately to rising retirement inequality in America. One part of this story that doesn’t get much attention is the role of traditional pensions in equalizing retirement outcomes - and my guest this week has plenty to say on that topic.

Monique Morrissey is an economist specializing in retirement security and financial markets at the Economic Policy Institute in Washington. EPI has made its mark as the premier think tank in D.C. focused on the economic condition of low- and middle-income Americans. Notably nearly 30 percent of its support comes from organized labor, which makes it a little different than the typical Washington think tank.

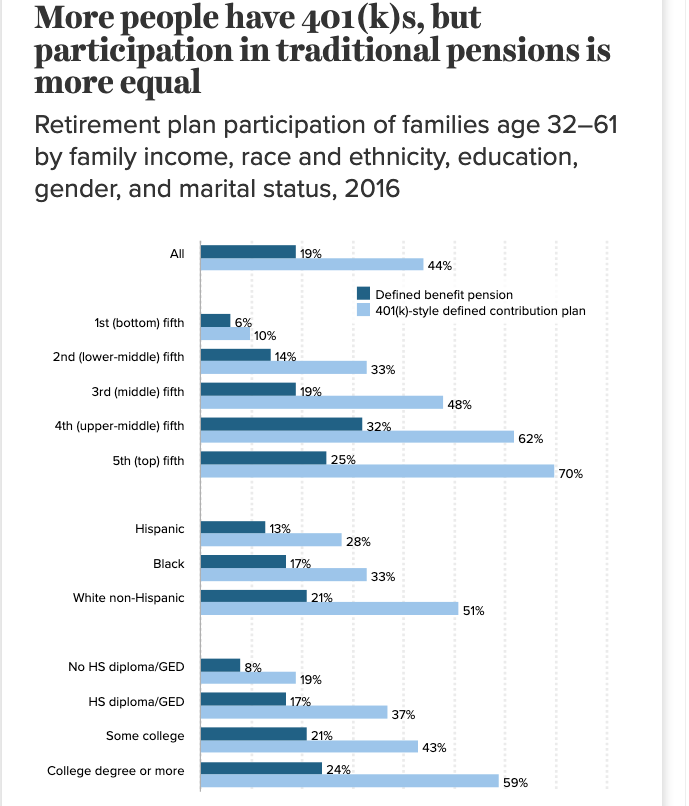

Morrissey recently published a research brief focusing on ways that the shift away from traditional pensions, and toward 401ks, has increased the gaps in retirement readiness based on income, race, education and marital status. The brief make its case through a series of charts based on Federal Reserve data, accompanied by commentary. It paints a troubling picture.

Morrissey argues that the shift away from pensions has been disastrous for low income people, blacks, Hispanics and single workers, and people without college degrees. But more affluent households often don’t have adequate retirement savings or benefits either - and women are much more vulnerable in retirement due to their lower lifetime earnings and longer life expectancy.

More than twice as many families have defined contribution plans as defined benefit pensions, but participation in pensions is more equal across education, race, and income groups. she found:

Pensions are concentrated mostly in the public sector these days, but overall about one in five workers still does participate in these plans, she finds. For those workers, retirement income is distributed more evenly because of the universal participation - and the fact that benefit credits accrue automatically, no matter your level of contribution.

Morrissey argues that that our current retirement system does not work for most workers. As a result, we need to preserve and expand Social Security, defend defined benefit pensions for workers who have them, and find new solutions for those who do not.

To listen to my interview with Monique Morrissey, click the player icon at the top of this newsletter.

The podcast also can be found on Apple Podcasts, Spotify and Stitcher.

Subscribe now!

This is a listener-supported project, so please consider subscribing.

The podcast is part of the subscription RetirementRevised newsletter. Subscribers have access to all the podcasts, plus my series of retirement guides on key challenges in retirement. Each guide is paired with a podcast interview with an expert on the topic; the series already covers Social Security claiming and the transition to Medicare, and how to hire a financial planner. The most recent looks at the critical decision between Original Medicare and Medicare Advantage.

Readers also get my weekly summary and analysis of key developments in retirement. This week, you’ll learn about several new reports on trends in longevity, how the new SECURE Act is impacting estate plans, and whether the coverage gap in Medicare Part D (the donut hole) has really closed.

You can subscribe by clicking the little green “subscribe now” link at the bottom of this page, or by visiting RetirementRevised.com. And if you’re listening on Apple Podcasts, Spotify or Stitcher, I hope you’ll leave a review and comment to let me know what you think.

Share this post