This week, the podcast dives into the topic of Medicare’s fall enrollment period. Every fall, enrollees have the opportunity to do a check-up on their prescription drug or Medicare Advantage insurance coverage, and shop for new insurance plans if their coverage doesn’t meet current needs. This is done during a fall enrollment period that runs from October 15th through December 7th.

Most Medicare enrollees don’t bother to do this check-up, but they should. Insurance plans can - and do - change what will be covered from year to year, and the list of health care providers in Advantage plans can change. And studies show that updating your coverage often saves money.

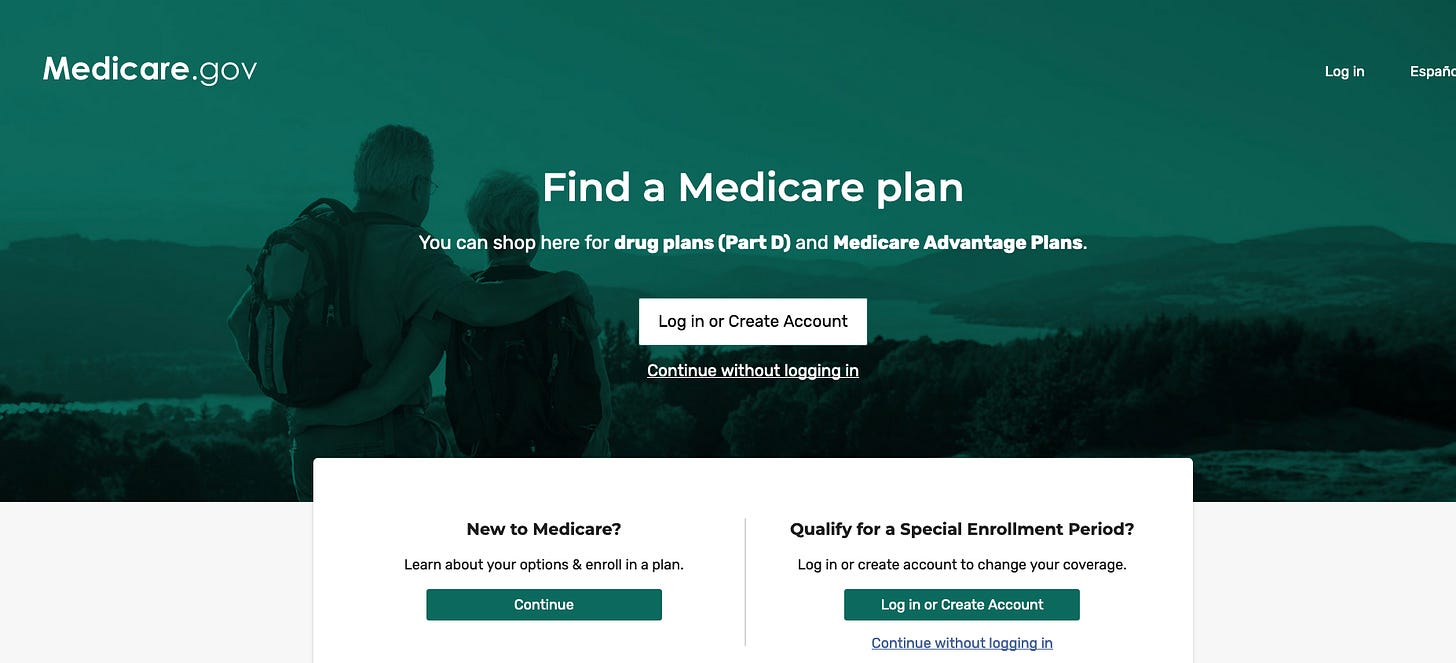

I’ll be writing several articles about fall enrollment over the next few weeks, but already have done some reporting on a new wrinkle that comes along with this year’s enrollment season. The wrinkle has to do with the go-to shopping resource people use to shop for plans. This is the Medicare Plan Finder - the official government site that posts insurance plan offerings.

The Plan Finder has had some problems. Studies have found that users are confused by the site navigation. The information displayed is often incomplete or incorrect. Even expert counselors who are trained to help people with their selections give the site poor marks.

Just before Labor Day, Medicare launched a new version of the Plan Finder that aims to correct some of these problems. The jury is still out on the new site, but the timing of the rollout has alarmed many of the experts who work with people on enrollment, because they have not had time to adequately train people to use it or test it for bugs. And Medicare says it will keep making tweaks between now and the start of fall enrollment.

My guest on the podcast today is one of those experts. Ann Kayrish is the senior program manager for Medicare at the National Council on Aging. She focuses on helping groups around the country that provide counseling to Medicare enrollees with their applications and benefit enrollment. Prior to joining NCOA, Ann directed operations for the State Health Insurance Assistance Program in Montgomery County, which helps the most vulnerable populations gain access to the health care benefits and services.

So Ann is one of the people very close to the issues with Medicare Plan Finder and what’s been going on with it lately.

Listen to the podcast by clicking on the player icon at the top of this page.

Subscribe now!

This is a listener-supported project, so please consider subscribing.

The podcast is part of the subscription RetirementRevised newsletter. Subscribers have access to all the podcasts, plus my series of retirement guides on key challenges in retirement. The series includes topics like Social Security claiming and the transition to Medicare. The series also will include guides to housing strategies for retirement, working longer as a retirement plan and much more. For a sample, check out the recently-published guide to the cost of healthcare in retirement, featuring an interview with retirement educator and actuary Steve Vernon.

You can subscribe by clicking the little green “subscribe now” link at the bottom of this page, or by visiting RetirementRevised.com. And if you’re listening on Apple Podcasts or Stitcher, I hope you’ll leave a review and comment to let me know what you think.

Share this post