This week, a panel of outstanding journalists joins me on the podcast to talk about how retirement has changed during the decade now ending. The topic has been on my mind lately, as I published a story in The New York Times last weekend examining the changes we’ve seen since 2010, when the economy was just beginning to recover from the financial crash and Great Recession.

Joining me are three colleagues on the aging beat:

Judy Graham, who writes the Navigating Aging column for Kaiser Health News. Judy was was a senior health correspondent for many years at the Chicago Tribune, and has written for the New York Times, Washington Post and Los Angeles Times, among many other publications.

Chris Farrell, senior economics contributor at Marketplace, American Public Media’s nationally syndicated public radio business and economic program. Chris also is an economics commentator for Minnesota Public Radio. His most recent book is Purpose and a Paycheck: Finding Meaning, Money, and Happiness is the Second Half of Life.

Richard Eisenberg, Managing Editor of Next Avenue, the public media site for people 50+, where he is also editor of its Money & Policy and Work & Purpose channels. Previously, Rich was Executive Editor of Money magazine, Front Page Finance Editor at Yahoo! and Special Projects Editor/Money Editor at Good Housekeeping. He is the author of the books How to Avoid a Midlife Financial Crisis and The Money Book of Personal Finance.

Reporting and writing the Times article prompted some reflection. I began to cover retirement just before the recession, and my first book, The Hard Times Guide to Retirement Security (2010) was published in the depths of the downturn. Those first few years on the beat, my reporting was very focused on the wreckage - the unemployment rate was high, the stock market was coming back and millions of workers were worried that their retirement plans were ruined.

How are we doing now? It’s a very mixed bag. The Times story considers the state of retirement security from the standpoint of saving and investing, health insurance, employment, housing and Social Security. The key finding:

Retirement in America has become a tale of two very different realities in the decade now drawing to a close.

In 2010, the economy was just beginning to recover from the worst recession and financial crisis in recent memory. The unemployment rate was high, the stock market was coming back and millions of workers were worried that their retirement plans were ruined.

Since then, a robust economic rebound has put some Americans back on solid footing for retirement, but progress has been uneven. Despite the gains made in employment, wage growth has only recently begun to recover — and remained flat for older workers. Retirement wealth has accumulated almost exclusively among higher-income households, while middle- and lower-income households have only held steady or lost ground, Federal Reserve data shows.

Trends in Social Security and Medicare also are troubling. The value of Social Security benefits — measured by the share of pre-retirement income they replace — is falling, and the cost of Medicare is rising.

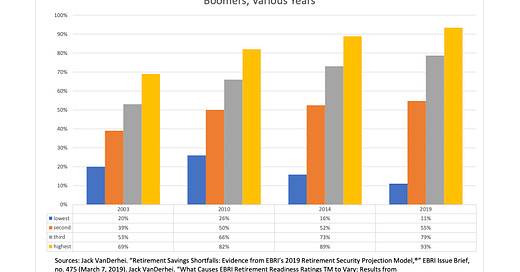

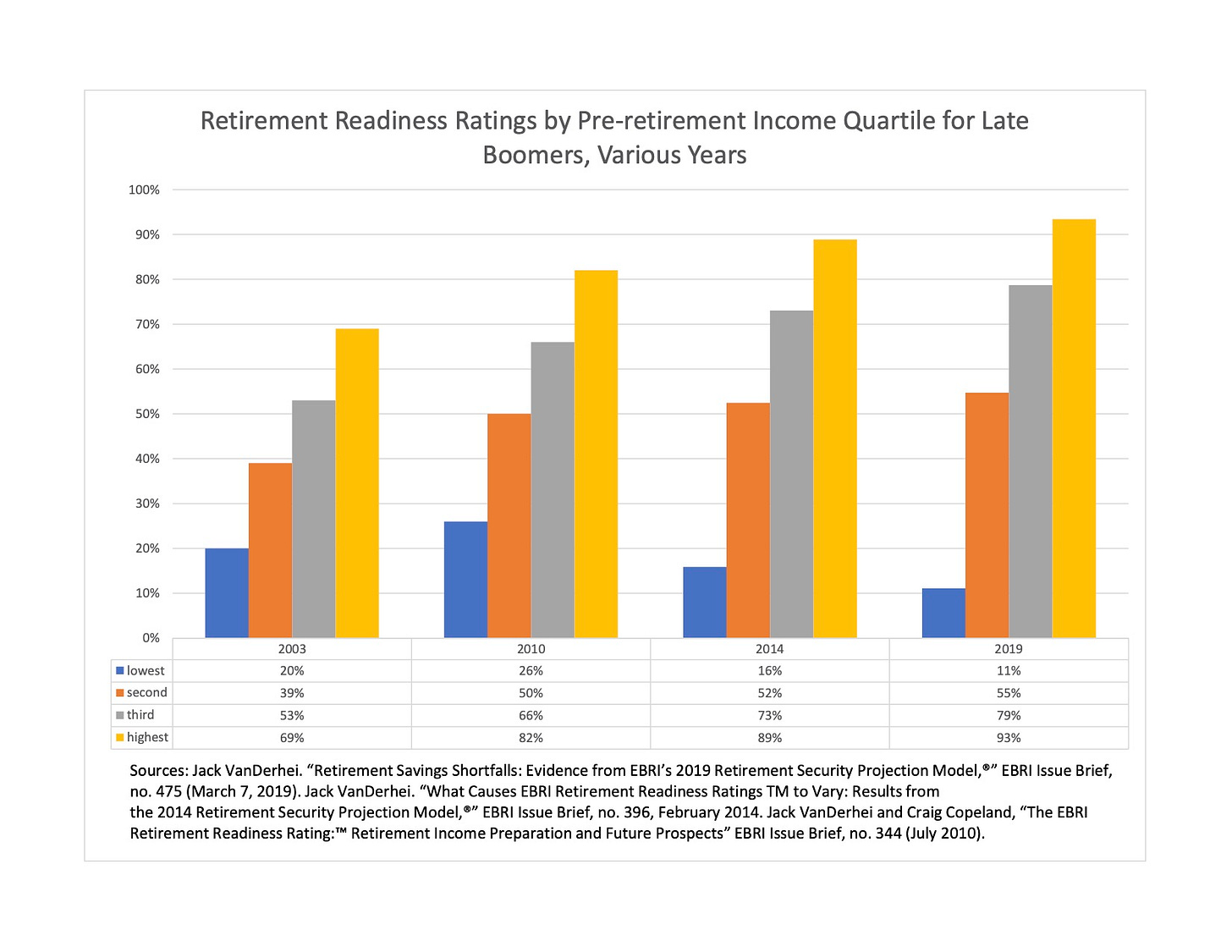

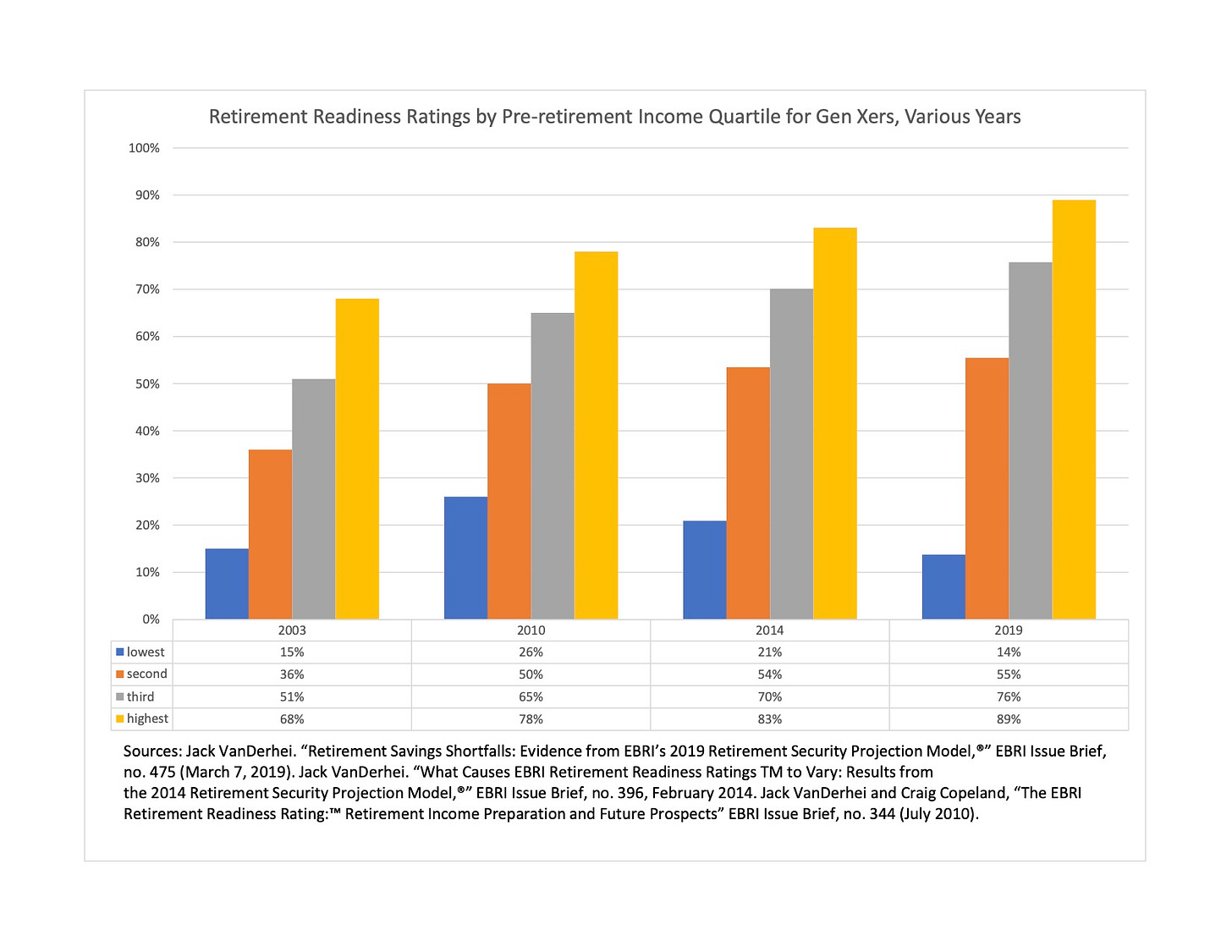

Some of the most striking data comes from the Employee Benefit Research Institute, which has developed a model that simulates the percentage of households likely to have adequate resources to meet retirement expenses. The model considers household savings, home equity and income from Social Security and pensions.

The model shows that the highest-income households have seen their odds of a successful retirement improve sharply during this decade, and they have very high odds of success. Middle-income households, meanwhile, have seen some gains, but still have only 50-50 odds of success. And the lowest-income households have seen their retirement prospects diminish sharply.

This chart depicts the odds for boomers age 55-64 - the color bars represent different income quartiles (blue is lowest, yellow is highest). In 2019, the highest income households have a 93% chance of a successful retirement - up substantially since 2010, while the lowest had odds of just 11% - down substantially over that period.

This chart depicts the same divergent trend among GenXers:

A few things that I had hoped to discuss in the article wound up on the cutting room floor for space reasons, so I’ll mention them briefly here:

Consumer protection: The crash gave birth to the Dodd–Frank Wall Street Reform and Consumer Protection Act in 2010, which called for sweeping reforms to financial regulation — including financial advice on retirement.

Dodd-Frank included language encouraging the Securities and Exchange Commission to adopt a uniform standard of fiduciary responsibility for brokers and advisers.

“That was the point when it seemed possible we’d soon have a strong standard of conduct across the broad range of investment advice for retail investors to be protected in retirement plans,” said Barbara Roper, director of investor protection for the Consumer Federation of America.

It wasn’t to be.

When the S.E.C. failed to act promptly, the Obama-era Department of Labor adopted its own fiduciary rule governing retirement accounts. That rule died in 2018 when courts sided with opponents in the financial services and insurance industries, ruling that the department had overstepped its authority. The Securities and Exchange Commission completed work this year on its so-called Regulation Best Interest, which defines standards for brokers who sell investment products and explains the duties of investment advisers who provide financial guidance. Many critics regard the S.E.C. regulation as too weak, relying too heavily on disclosure to clients of any conflicts of interest.

“One of the things that has really taken people by surprise in the S.E.C. rule is the degree to which they have adopted the weakest possible interpretation of the obligations investment advisers have as fiduciaries,” Ms. Roper said.

Shifting Social Security politics: The political debate about how to solve Social Security’s long-range financial shortfall shifted significantly during the decade.

In 2010, the bipartisan Bowles-Simpson presidential commission recommended changes that included further increases in the retirement age, a less generous cost-of-living adjustment and means testing for high-income workers.

In 2019, Democrats’ plans are built around higher taxes and expanded benefits — and President Trump campaigned in 2016 promising to oppose benefit cuts.

“The shift in the Democratic Party has been dramatic,” says Nancy Altman, president of Social Security Works, an advocacy group. “In contrast, the Republicans haven’t changed. They still want cuts and they still want to avoid accountability for those cuts.”

Subscribe now!

This is a listener-supported project, so please consider subscribing.

The podcast is part of the subscription RetirementRevised newsletter. Subscribers have access to all the podcasts, plus my series of retirement guides on key challenges in retirement. Each guide is paired with a podcast interview with an expert on the topic; the series already covers Social Security claiming and the transition to Medicare, and how to hire a financial planner. The most recent looks at the critical decision between Original Medicare and Medicare Advantage.

You can subscribe by clicking the little green “subscribe now” link at the bottom of this page, or by visiting RetirementRevised.com. And if you’re listening on Apple Podcasts, Spotify or Stitcher, I hope you’ll leave a review and comment to let me know what you think.