The podcast this week is a follow-up to my recent story for The New York Times on Medicare and COVID-19. The topic is important, since older Americans are at a high risk for serious illness from the coronavirus, and most who are over age 65 are covered by Medicare.

My guests are two of the top experts in the country on Medicare - Tricia Neuman and Juliette Cubanski of the Kaiser Family Foundation. Kaiser is one of the nation’s premiere sources of research and information on all aspects of health care and health policy. It’s a non-profit organization, and non-partisan, and it’s been a key go-to source for me for years. Tricia is a senior vice president of the foundation and executive director of its Program on Medicare Policy. Juliette Cubanski is the program’s deputy director.

Medicare already covers its enrollees for much of what they might need if they contract the virus and become seriously ill — and it has expanded some services and loosened some rules in response to the crisis.

I asked Tricia and Juliette about Medicare coverage of COVID-19 testing and care, as well as what’s going on with skilled nursing care, network restrictions and expanded telehealth options. We also went over a wish list of things Congress should consider adding to Medicare, or reforming, to help meet this crisis.

Listen to the podcast by clicking the player icon at the top of this page. The podcast also can be found on Apple Podcasts, Spotify and Stitcher.

Social Security field office closings

Social Security local offices are now closed to the public. Some field office staff are still reporting for work, and others are working virtually. The offices are offering in-person assistance for a short list of crucial services. These include reinstatement of benefits in dire circumstances; assistance to people with severe disabilities, blindness or terminal illnesses; and people in dire need of eligibility decisions for Supplemental Security Income or Medicaid eligibility related to work status. Those seeking these services must call in advance.

Another situation that may require you to interact with a local field office is if you are filing for Medicare benefits for the first time and are past the initial filing age of 65. In that situation, call your local office to get the application started, because there will be a couple forms that need to be filed. I describe that in more detail here.

If you need to visit a local Social Security office for in-person services, call the office to request an appointment. You can find the closest office using an office locator tool on the Social Security website, where the agency is also providing updates and information on services

Answering your questions: RMDs for 2020

I’ve been answering listener questions about the COVID-19 crisis here on the podcast. And this week, I received several questions about the new suspension of required minimum distributions for retirement accounts under the CARES Act, passed by Congress last week. No one needs to take an RMD for 2020, and there are a couple little twists and turns for people who may have already taken them. Joining me on the podcast to answer these question is IRS expert Ed Slott; if you are looking for guidance on this issue, just skip ahead to the 44 minute mark. Ed has a useful article on RMDs at the AARP website.

Send in your questions on retirement and COVID-19

Like everyone else, I’ve been struggling to adjust to the new realities that are dawning in our country and our world. And like a lot of people, I’m trying to figure out how to be useful to others. Fortunately, I practice a craft dedicated to providing quality, fact-checked information - and that can be invaluable in a crisis. I’m pivoting much of my work toward coverage of COVID19 and how it impacts older Americans, and I want to be sure to answer the questions that are on your mind.

One way I’m going to be doing that is through a question hotline. You can give me a call and leave a message with your question. I’ll try to answer your question in a future edition of my podcast and newsletter, or in an article for one of the other news outlets that I write for.

I’m not an expert on health care, so I won’t be answering questions on that. But I am well positioned to answer questions about this crisis as it relates to topics like Social Security, Medicare and other insurance questions, and personal finance issues related to retirement. I also write about topics like careers in later life and volunteering.

If you want to submit a question, call me on this number and leave a message: (847) 238-2015. Please include your name and a phone number where you can be reached if I have follow-up questions for you. If you prefer to remain anonymous, leaving your first name only is fine.

You also can use this link to submit a question through my website. Click on “Contact” near the upper right corner of the page.

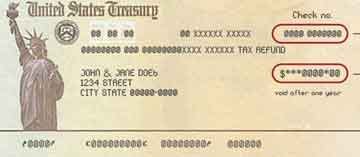

About those $1,200 government checks for Social Security beneficiaries

A fracas erupted this week when the IRS indicated that Social Security beneficiaries who don’t file tax returns would need to do so in order to receive their $1,200 stimulus checks. That’s many millions of Social Security recipients, and the IRS stated earlier in the week that these folks would “need to file a simple tax return" to receive their checks.

That was at odds with the intent of Congress; the CARES Act gave the U.S. Treasury permission to use Social Security records and payment set-ups to make payments automatically. When I was reporting on this last week, the speculation was that the $1,200 would simply be added to monthly electronic benefit payments.

After protests erupted, the government backtracked. The automatic payments will take place after all. Learn more about it here.

But the Trump administration is still taking the position that recipients of Supplemental Security Income and veterans pensions file a tax return, unless they are also Social Security beneficiaries:

This requirement that a tax return be filed has been used before, and the result was that many miss out on the payment inadvertently. When stimulus checks were distributed in 2008, it seems that about 3.5 million Social Security beneficiaries and veterans never received the checks.

Scams continue - be careful out there

Fraud watchdogs warn that Social Security and Medicare scammers are taking advantage of the crisis to ramp up identity theft and other fraud schemes. I can’t even begin to fathom the depth of this depravity, but I can pass along warnings to you.

Here’s an article from the Associated Press on what’s going on with Medicare fraud. And journalist Mary Beth Franklin notes the latest:

COVID-19 and retirement roundup: What else I’m reading

The question we should have been asking all along about risk . . . States are beginning to move COVID-19 patients to nursing facilities from hospitals . . . Some older workers who can’t work from home face COVID-19 risks . . . how financial plans must adapt to market crashes. So much for the OK Boomer meme: thousands of retired healthcare workers join the fight against COVID-19 .

Subscribe to the newsletter

If you haven’t subscribed to the free edition, give it a try if your finances permit in this tough economy. You’ll be supporting independent journalism dedicated to covering what matters for older Americans. Subscriptions cost $5 per month or $60 year, and you can cancel at any time.

If not, no worries - I’m committed to providing everything I’ve got on the coronavirus crisis in the free edition for as long as this lasts.