My guest on the podcast this week is a prominent exponent of a simple, straightforward approach to investing that emphasizes balance, diversification, discipline, low-costs, and a long-term orientation.

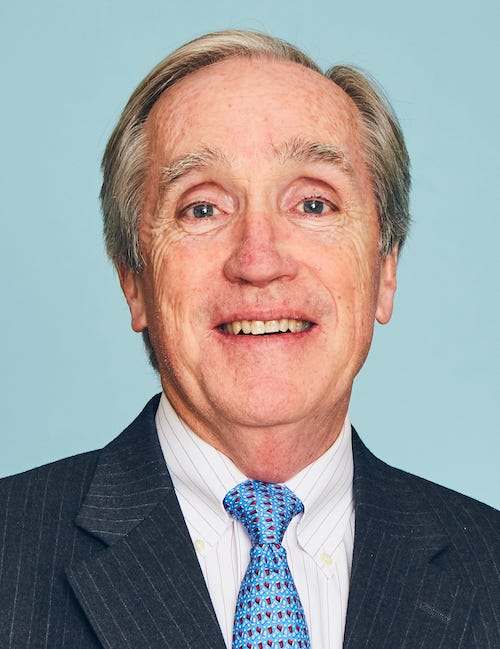

No surprise there - Jack Brennan is a former chief executive and board chair at Vanguard, which has come to dominate the world of consumer investing with its emphasis on those principals. Brennan remains involved at the company as chairman emeritus, and he is the author of a terrific new book, More Straight Talk on Investing.

Jack’s book offers excellent advice for investors of all ages, but I quizzed him about parts of the book most relevant to people nearing retirement or already retired. We discussed asset allocation, how to stay on track when things get rough, and why he believes strongly that retirees should have professional financial advice.

Listen to the podcast by clicking the player icon at the top of the newsletter. The podcast also can be found on Apple Podcasts, Spotify and Stitcher.

Guest post: Putting your investments in their place

This week I'm featuring a guest post on asset location from Bob French, CFA, the director of investment analysis at Retirement Researcher and McLean Asset Management. Bob will be holding a webinar covering the portfolio management process on Tuesday May 4th, and Wednesday May 5th. He'll be showing you how to keep your portfolio doing what you want it to do. You can sign up here.

Most people are leaving money on the table. For all the different ways that we try to optimize our investments, most people ignore their asset location – because they simply don’t know that it’s something they should be thinking about. But asset location is essentially free money just for being organized. Vanguard’s 2019 Advisor Alpha study found that asset location can add up to three quarters of a percent per year – again, just for being organized.

Asset location is about choosing which account you put your investments in to make the most out of the tax treatment of your different accounts. There are three different types of accounts: taxable, tax deferred, and tax exempt. We can use the differences in how they’re taxed to maximize our after tax returns.

Taxable accounts are things like your brokerage account, where you owe taxes on everything that happens in that year. Tax deferred accounts are your traditional IRAs and 401(k)s. These accounts don’t have the ongoing tax drag of a taxable account, but when you pull money out, you owe ordinary income taxes on that money. Tax exempt accounts, like your Roth IRA and 401(k) are, well, tax exempt. You don’t pay any ongoing taxes, and you don’t owe anything when you take your money out.

Your asset location should not drive your asset allocation. Your asset allocation is a strategic decision about how much risk (and return) you want to take. Your asset location is simply a tactical decision about how to implement your portfolio.

It’s also important to recognize that the benefits of asset location are dependent on the structure of your portfolio. If all of your money is in your traditional 401(k), there’s not much to do here – your money is where it is.

In practice, there are two general guidelines for your asset location. The first is that you want your tax inefficient investments – the ones that kick off a lot of distributions – in your tax deferred or tax exempt accounts. Those distributions would be a serious tax drag in your taxable account. The second is that you want your highest growth assets in your tax exempt account. You can think of the IRS as a silent partner in your taxable and tax deferred accounts, so they get some of the gains in those accounts. By keeping your highest return assets in your tax exempt accounts, you get to keep all of those gains.

The biggest upshot of implementing your asset location strategy is that you should try and get your bonds (especially TIPS – they have some nasty tax issues) into your tax deferred accounts, and then work from there.

If you want to find out more about asset location, or the other things you should be considering as you maintain your portfolio, sign up from my upcoming webinar, Managing Your Portfolio: the 6 Step Process to Maintaining the Portfolio You Designed on Tuesday May 4th, and Wednesday May 5th. You can register using this link.

Webinar: Tips for succeeding in the new world of work

“Businesses are planning for a future of less business travel, more automation and more people working from home," says a recent article in theWashington Post. What do changes like these mean for people over 50? According to Kerry Hannon and Marci Alboher, two of the nation's foremost authorities on opportunities for older workers, there are steps we can take to make this market work for us. In her upcoming book, Kerry says that people over 50 can "take control of their professional and economic future with hope, confidence and optimism."

In a May 20th fireside chat sponsored by the Encore Boston Network, Kerry and Marci will offer trends, tips and tactics about freelance and remote jobs, job search advice, self-employment and entrepreneurship and finding work you love. They will also discuss how to find your place in the increasingly diverse and multi-generational workforce and the role that mentoring plays in this next stage of encore work.

There’s a small fee to attend ($20 for non-members).

Subscribe to the newsletter

You’re subscribed to occasional, short posts sent to my free list. Sign up for the paid edition to receive my weekly in-depth report, plus online access to my series of retirement guides.