Remember the phrase “greedy geezers?” That was former Wyoming Senator Alan Simpson’s memorable description back in 2012 of seniors who receive Social Security. Simpson was co-chair back then of a bipartisan presidential commission on how to cut the federal deficit. The commission had recommended cuts to Social Security benefits as part of its deficit solution. That prompted a bit of a verbal firefight between Simpson - who always is colorful with his language - and advocates for seniors. Simpson called one seniors’ group nothing more than “greedy geezers” stealing from young people “who are going to get gutted.”

It was a good example of the colorful language of so-called “inter-generational warfare” -- pitting generations against one another with divisive zero-sum-game economic arguments.

That kind of rhetoric might be useful for some politicians, but it is economic nonsense. Families don’t live in economic silos, separated from one another, and some recent evidence shows that a large segment of the senior population is anything but greedy. In fact, they are struggling to meet basic living expenses - and the economic pain filters down to younger family members.

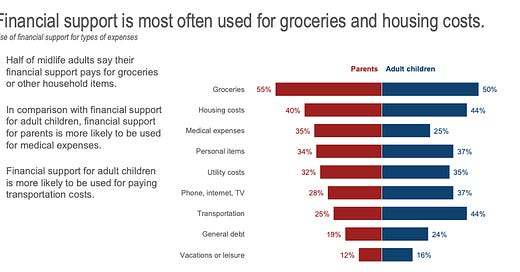

Consider a recent survey by AARP that found one-third of midlife adults with at least one living parent provide financial support to them. More than half provided $1,000 or more to their parents in the last year. Within that group, 34% provided up to $5,000, and 13% as much as $10,000.

The support goes mainly to help meet living expenses, such as groceries and medical costs.

These figures really are just the tip of the iceberg. A deeper dive into the data on elders and poverty show that the number of older households coping with financial stress is much larger than typically understood.

Joining me on the podcast this week to explore this is Jan Mutchler. She’s a professor of gerontology at the University of Massachusetts Boston. She works with the university’s Gerontology Institute, which produces something called the Elder Index. The index measures the cost of living for older people, looking at their typical budgets and income, adjusted for regional variations.

If you live below the Index, it means you don’t have the resources needed to meet basic living needs. The institute recently released new data for 2019, and it shows that half of Americans over age 65 living alone have incomes that are below the index . . .and the comparable figure for couples is 23%.

Those figures are shocking, and they are much more dire than the federal measure of poverty that are used to establish eligibility for many state and federal assistance programs.

I talked with Jan about what drives these numbers, and what needs to be done to drive them down.

Listen to the podcast by clicking the player icon at the top of this page. The podcast also can be found on Apple Podcasts, Spotify and Stitcher.

Subscribe now!

This is a listener-supported project, so please consider subscribing.

The podcast is part of the subscription RetirementRevised newsletter. Subscribers have access to all the podcasts, plus my weekly summary and analysis of key developments in retirement.

Subscribers also have access to my series of retirement guides on key challenges in retirement. Each guide is paired with a podcast interview with an expert on the topic; the series already covers Social Security claiming and the transition to Medicare, and how to hire a financial planner. The most recent looks at the critical decision between Original Medicare and Medicare Advantage.

You can subscribe by clicking the little green “subscribe now” link at the bottom of this page, or by visiting RetirementRevised.com. And if you’re listening on Apple Podcasts, Spotify or Stitcher, I hope you’ll leave a review and comment to let me know what you think.