This week on the podcast, we examine proposed Senate legislation to create Congressional “rescue committees” that could propose cutbacks to Social Security and Medicare benefits.

My guest is Nancy Altman, the president of Social Security Works, one of the leading progressive advocacy organizations for Social Security. Nancy also brings a unique vantage point as a scholar and historian of Social Security. And she also served on the staff of the Greenspan Commission, which succeeded in passing significant reforms to Social Security back in 1983.

Senator Mitt Romney of Utah is the sponsor of the TRUST Act, a bill I consider to be ironically named, because it could lead to benefit cuts for these programs through a secretive closed-door committee process. The TRUST Act has been rattling around Congress for a while, but now it may be included in whatever pandemic relief bill the Senate Republicans wind up proposing. Yes, you heard that right - in the middle of a pandemic, Senate Republicans may propose a review of Social Security and Medicare that could lead to cutting these vital programs.

The TRUST Act would require the U.S. Department of the Treasury to report to Congress on the health of the Social Security and Medicare trust funds within 45 days of passage. Congress would then appoint bipartisan committees to come up with recommendations by June of 2021. Then, lawmakers would be required to take an up or down vote on the proposals, with no amendments allowed.

Ok, first - let’s stipulate that these trust funds have problems that need to be addressed.

The Social Security trust fund is on track to be exhausted in about 15 years - at that point, it would have sufficient revenue coming in the door to pay roughly 80 percent of promised benefits. The Medicare hospital trust fund - which pays for Part A - is on track to be exhausted in 2026 - and it could be sooner than that due to the pandemic.

But we don’t need reports from Treasury to know these things - the Social Security and Medicare trustees issue exhaustive, authoritative financial health reports annually. And we don’t need new analysis of ways to reform the programs - numerous studies, reports and Congressional hearings have been held in recent years, featuring testimony from experts representing all political and policy perspectives.

But there’s a good reason why Republicans want this debated away from the public eye, especially where Social Security is concerned. Simply put, they want to advance ideas that the public doesn’t support, like higher retirement ages, means testing and a stingier annual cost of living increase. That is clear from their own legislative proposals in recent years, and the ideas they push in bipartisan policy settings, such as the 2016 report issued on retirement policy by the Bipartisan Policy Center. But public poll after public poll has shown that given the choice, the public would prefer higher taxes over benefit cuts.

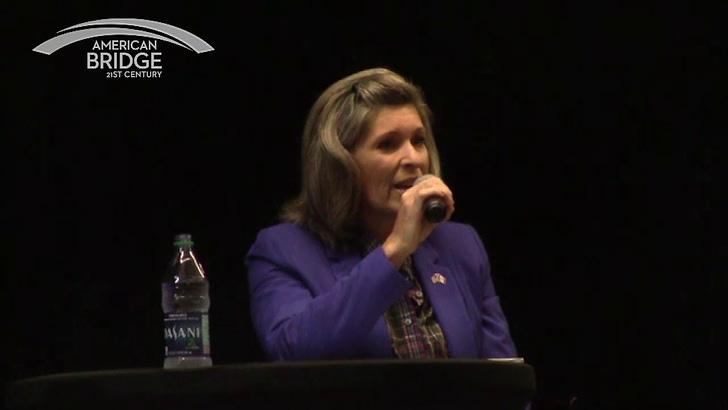

Sometimes, the Republicans come right out in the open and tell you why they want the debate to occur in private. Here’s Iowa Senator Joni Ernst at a town hall meeting last year:

Click the player icon at the top of this page to listen to the podcast. And here’s my Reuters column this week, which discusses the TRUST Act.

Not a subscriber yet? Take advantage of a special offer

Sign up now for the free or subscriber edition of the newsletter, and I’ll email a copy of my latest retirement guide to you. This one looks at dealing with the Social Security Administration during the COVID19 crisis.

Customer service at the Social Security Administration has changed during the coronavirus crisis - the agency closed its network of more than 1,200 field offices to the public in March.

Just a reminder- subscribers, have access to the entire series of guides at any time. Click on the little green button to subscribe, or go here to learn more.

Why it’s time to fire your broker

Jay Abolofia thinks it’s time to get rid of your broker.

Jay is a fiduciary CFP, founder of his own planning firm, Lyon Financial Planning and an economist. You may recall that he joined me on the podcast back in March to talk about how to deal with fear of stock market volatility.

Jay recently got back in touch with me about an article he posted on the high cost and financial conflicts involved in working with a stock broker - a timely topic, since the Security and Exchange Commission’s new (and toothless) “Regulation Best Interest” took effect recently.

Jay’s post is titled Why it’s time to break up with your broker, and it details the numerous conflicts of interest and high fees that pose major barriers to your financial success. I’ve been highlighting this topic for years, but Jay did some great digging into the disclosure forms of the major brokerage firms, so I asked his permission to cross-post his article here:

In his book The Four Pillars of Investing, financial theorist and author William Bernstein puts it bluntly:

“Under no circumstances should you have anything to do with a full-service brokerage firm . . . Severing that professional relationship is necessary to your financial survival.”

This is often easier said than done, as your broker may be your neighbor, friend or even family. In what follows, I shed light on the conflicts of interest and excessive fees that are commonplace in the brokerage industry today. (Please proceed with caution. What I’m about to share may shock you.)

Your Broker is Not Your Buddy

A stockbroker is a person in the business of buying and selling financial securities on behalf of customers. Long story short, a stockbroker is a professional salesperson. Brokers need trades to make money. Unlike investment advisors, who must register with the SEC or state securities regulator, brokers are not fiduciaries. Rather than being required by law to act in their clients’ best interest (like doctors, lawyers, bankers and accountants), brokers are instead subject to a “suitability” standard upheld by a private-sector organization. This standard says that brokers should “have a reasonable basis to believe a recommended transaction or investment strategy is suitable for the customer.” Yes, you read that correctly! As the old adage goes, a broker’s job is to slowly transfer his client’s assets to his own name.

There are no educational requirements to be a broker. No courses in finance, economics or law. Not even a high-school diploma. Earn a 72% on the simple multiple choice Series 7 exam and you’re ready to manage other peoples’ life savings. Spend five minutes reading my Four Steps to Successful Long-term Investing and you’ll know far more than the average broker.

Brokers have one incentive, and that is to earn their commission. This creates a minefield of conflicts. In their so-called Important Account Information booklet, a disclosure document hidden deeply within their website, Morgan Stanley beautifully summarizes many of these conflicts of interest. I count over twenty major conflicts (see pages 7-12). These read like a coup de grâce. Here are five I find particularly egregious.

“A Financial Advisor has an incentive to recommend more transactions or to break transactions into smaller increments that might generate higher and more frequent commissions.”

“A Financial Advisor has an incentive to recommend that you add more assets to your account, as it will generate a higher asset-based fee . . . [and earn them more] compensation based on certain milestones.”

“Financial Advisors may receive more or less compensation if, for example, clients select certain products over others.”

“Financial Advisors, could engage in outside business activities and investments or have outside or pre-existing relationships with product or service providers that conflict with their job responsibilities."

"Financial Advisors are also compensated when their clients borrow funds."

In short, you can’t trust much of anything your broker says. It’s not because they are inherently bad. It’s because they are trained and incentivized to sell, not to deliver objective advice.

Your Broker Charges Exorbitant Asset-Based Fees

Brokers are typically paid an investment management fee based on the amount of assets they manage in your accounts. These are called asset-based or assets under management (AUM) fees. These fees may or may not include any financial planning your broker provides and may be in addition to other fees, commissions, fund expenses, taxes, and investment-related costs. For example, a 2% AUM fee means you’ll pay $20K in fees this year on a $1M account. As the account grows, the fee grows proportionately.

Below is a summary of AUM fees charged by some of the largest brokerage firms for their most common investment management service for retail customers. Morgan Stanley, Ameriprise and Wells Fargo take the cake for highest fees. Although publicly available, this information is a bear to uncover.[1] These fees are typically assessed on at least the first $1-5M in the account, depending on the broker and service, with slightly lower fees assessed on higher account balances.

Two percent might not sound like much, until you consider that it’s ¼ to ½ of the gross annual return you may expect to earn in your accounts. Over years of investing, this can add up to hundreds of thousands of dollars lost, both to fees and lost investment growth—every dollar paid in fees is one less dollar earning compound interest in your account. With a 2% AUM fee, a $1M account growing at 6% a year will result in cumulative fees over 20 years of $623K and $443K in lost investment growth. This amounts to a loss of over $1M, or 48% of the account’s cumulative growth!

Break Up With Your Broker

Given these major conflicts of interest and exorbitant asset-based fees, Bernstein’s advice to break up with your broker really adds up. You’ll likely get much better financial advice and save hundreds of thousands of dollars by working with an independent, fee-only fiduciary. One with solid credentials and experience, who provides comprehensive financial planning, not just investment advice or management. Better yet, find an advisor who does all of this for a straightforward fixed-fee and your future self will thank you!

[1] Fee information can often be found in the firm’s disclosure documents. For example, read the section on “fees and compensation” in the firm’s “wrap fee” program brochure or ADV Part 2A. Here are source links I used for each firm: Morgan Stanley, Ameriprise, Wells Fargo, Merrill Lynch, Edward Jones, UBS, Fidelity, Charles Schwab.